Borrowing costs moved even lower this week, with the 30-year fixed-rate mortgage averaging 3.73 percent, its lowest average since May 2013.

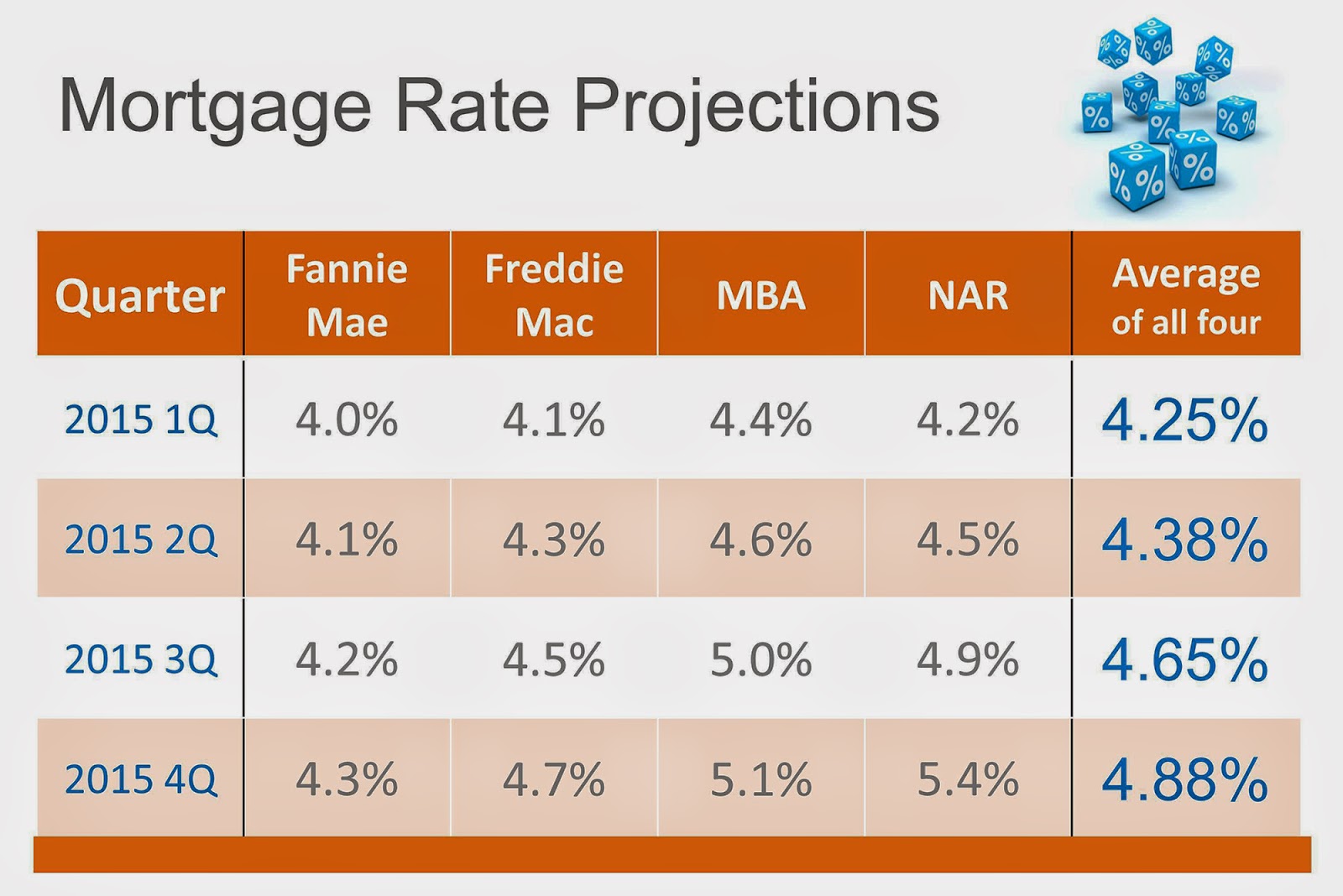

"Mortgage rates fell to begin the year as 10-year Treasury yields slid beneath 2 percent for the first time in three months,” says Frank Nothaft, Freddie Mac’s chief economist. “Meanwhile, the Fed minutes indicated ongoing discussion regarding the timing of the first rate hike.” Many housing economists have predicted that mortgage rates will rise sometime this year, with the 30-year fixed-rate mortgage likely reaching the upper 4 percent or 5 percent range by the end of the year.

- Freddie Mac reports the following national averages with mortgage rates for the week ending Jan. 8:

- 30-year fixed-rate mortgages: averaged 3.73 percent this week, with an average 0.6 point, dropping from last week’s 3.87 percent average. The 30-year rate has not averaged this low since May 23, 2013, when it was 3.59 percent. A year ago at this time, 30-year rates averaged 4.51 percent.

- 15-year fixed-rate mortgages: averaged 3.05 percent, with an average 0.5 point, dropping from last week’s 3.15 percent average. Last year at this time, 15-year rates averaged 3.56 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 2.98 percent, with an average 0.5 point, dropping from last week’s 3.01 percent average. A year ago, 5-year ARMs averaged 3.15 percent.

- 1-year ARMs: averaged 2.39 percent, with an average 0.4 point, falling from a 2.40 percent average the previous week. Last year at this time, 1-year ARMs averaged 2.56 percent.