The Gallup organization just released their April Economy and Personal Finances Poll

which asked Americans to choose the best option for long term

investment. It was no surprise to us that real estate returned to the

top position over other investment categories (gold, stocks/mutual

funds, savings accounts/CDs and bonds).

Back in 2011, gold was the most popular long-term investment among

Americans. However, with the housing market improving across the U.S.

and home prices rising, more Americans now consider real estate the best

option for long-term investments.

Visit www.brandyfarris.com for thousands of homes in your area!

Showing posts with label First Time Home Buyer. Show all posts

Showing posts with label First Time Home Buyer. Show all posts

Monday, April 28, 2014

Monday, April 21, 2014

Either Way, You're Still Paying a Mortgage

There are some people that have not purchased a home because they are

uncomfortable taking on the obligation of a mortgage. Everyone should

realize that, unless you are living with our parents rent free, you are

paying a mortgage - either your mortgage or your landlord’s.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

Thursday, April 17, 2014

Real Estate: This Spring Will Be Different

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

MILLENNIALS

Contrary to many reports, this age demographic is READY, WILLING and ABLE to become homeowners. As a matter of fact, the latest National Association of Realtors’ gender study revealed that the Millennial generation has recently accounted for a greater percentage of all buyers than any other generation.

BABY BOOMERS

As prices have risen, so has the equity in many homes across American. Homeowners, having been shackled to their house because of low or negative equity for the last several years, are again free to make a move without worrying about bringing cash to a closing table in order to sell. We believe this new-found freedom will release a pent-up demand of sellers who want to move-up to the home they’ve always dreamed of or want to downsize their primary residence and also purchase a second home they can use for vacation, retirement or both.BOTH PRICES and MORTGAGE RATES are on the RISE

As the economy improves, more and more Americans are regaining faith that their ownpersonal finances are headed in a positive direction. With this new confidence, they want to take advantage of the opportunity that presents itself with real estate still undervalued in most parts of the country and mortgage rates being well below historic numbers.

Wednesday, April 16, 2014

Current Mortgage Rates Won't Last Forever..

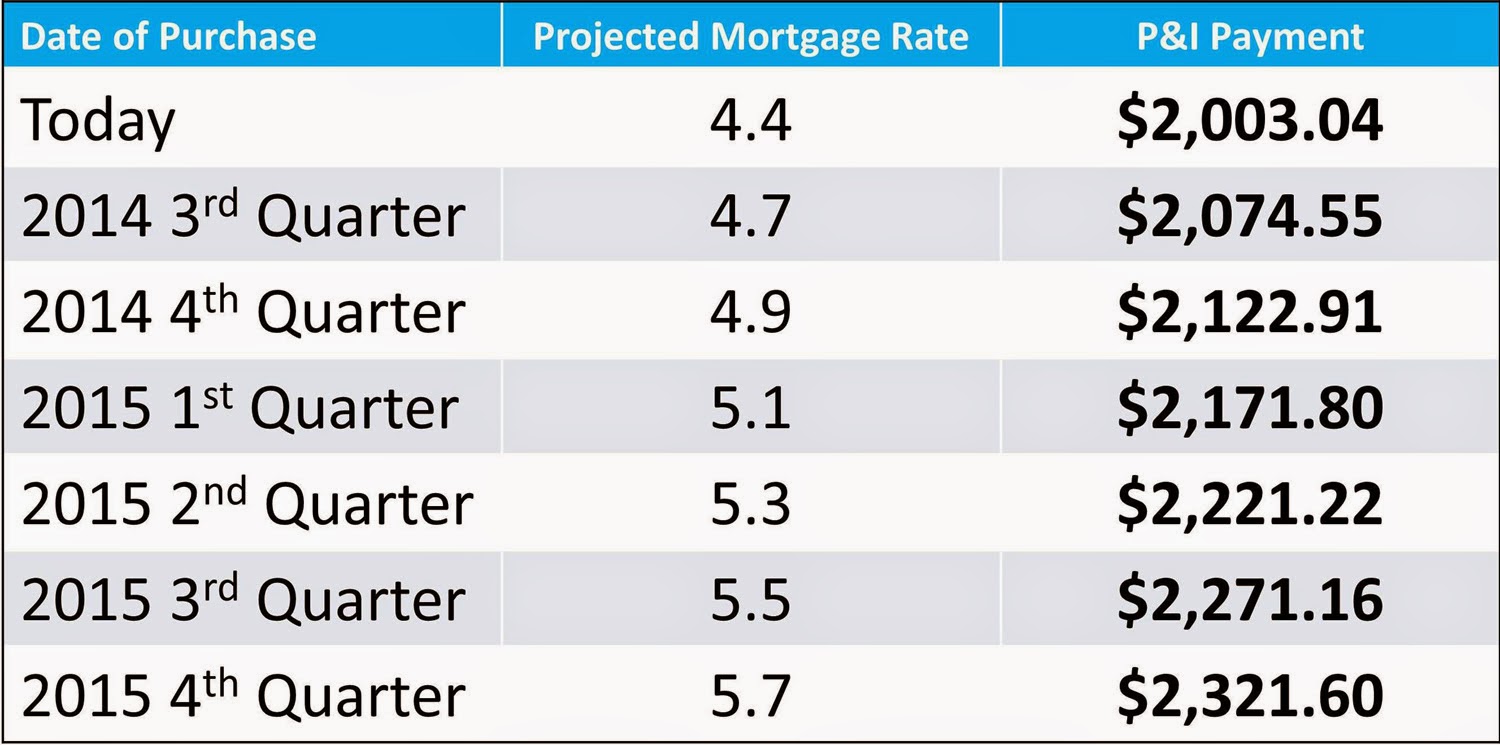

According to FreddieMac, the interest rate for a 30 year fixed rate mortgage at the beginning of April was 4.4%. However, FreddieMac predicts that mortgage rates will steadily climb over the next six quarters.

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Friday, April 11, 2014

Homeownership's Impact on Net Worth

Over the last six years, homeownership has lost some of its allure as

a financial investment. As homeowners suffered through the housing

bust, more and more began to question whether owning a home was truly a

good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

Monday, April 7, 2014

A Home's Cost VS. Price

Let's talk about the difference between COST and PRICE. As a

home seller, you will be most concerned about ‘short term price’ – where

home values are headed over the next six months. As either a first time

or repeat buyer, you must not be concerned about price but instead about

the ‘long term cost’ of the home. Let us explain.

Recently, it was reported that a nationwide panel of over one hundred economists, real estate experts and investment & market strategists projected that home values would appreciate by approximately 8% from now to the end of 2015.

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30 year fixed mortgage rate will be 5.7% by the end of next year!

Recently, it was reported that a nationwide panel of over one hundred economists, real estate experts and investment & market strategists projected that home values would appreciate by approximately 8% from now to the end of 2015.

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30 year fixed mortgage rate will be 5.7% by the end of next year!

What Does This Mean to a Buyer?

Here is a simple demonstration of what impact these projected changes would have on the mortgage payment of a home selling for approximately $250,000 today:Thursday, March 27, 2014

3 Reasons the Housing Market Should Thrive in 2014

Recently, HousingWire asked David Berson, chief economist at Nationwide, for his opinion on the near-term future of housing. Below are what Mr. Berson believes to be the three things you need to know about housing in 2014. We have included a quote from the article and a small comment from KCM for all three points.

Number 1: 2014 should prove to be the strongest year for housing activity since before the Great Recession

“Most economists expect an improved job market in 2014, with employment growth accelerating and the unemployment rate continuing to decline. That jobless rate drop will reflect more of a pickup in employment than further declines in the labor force participation rate. This will be the key factor improving housing demand this year, even if mortgage rates rise and affordability declines. While the housing market tends to do especially well when the job market improves and mortgage rates decline simultaneously, that combination of events occurs only rarely…People buy homes when their job and income prospects improve – even if it’s more expensive to do so – rather than buy when it is inexpensive to do so but they’re worried about keeping their jobs.”KCM Comment:

We agree that the job market will continue to improve and that rising interest rates will not be a detriment to the market in 2014. As Doug Duncan, SVP and chief economist at Fannie Mae, recently revealed:“Consumers have taken the interest rate rise in stride. Expectations for continued improvement in housing persist, and sentiment toward the current buying and selling environment is back on track.”

Number 2: Demographics should start to favor housing activity

“If the economy expands at a faster pace this year, bringing a more rapid rate of job creation, that should translate into more households, raising housing demand. We won’t see all three million missing households return to the housing market at once. (That wouldn’t be a good thing for the housing market anyway, since that would be on top of the 1.2 million households that normally would develop this year; such a surge would swamp the existing housing supply). Beginning in 2014, the pace of household formations should accelerate to an above-trend pace for several years, pushing up housing demand.”KCM Comment:

The Urban Land Institute recently released a report, Emerging Trends in Real Estate 2014, projecting that 4.48 million new households will be formed over the next three years. Millennials will make up a large portion of these new households. With the economy improving, we believe they will finally be moving out of their parents’ homes and, after they compare renting versus buying, many will choose homeownership.Number 3: Mortgage availability shouldn’t worsen and may improve

“The rise in mortgage rates already has reduced mortgage origination volumes as refinance activity declines. If mortgage rates rise further this year, as expected, then refinance activity will fall still more. In response, mortgage lenders probably will ease lending standards to the extent possible under the QM rules to boost lending activity by increasing purchase originations. As a result, the increase in new households expected to be created this year, spurred by a stronger job market, should find that qualifying for a mortgage loan will be somewhat easier in 2014 than in prior years.”KCM Comment:

We also believe that, as the refinancing market begins to dry up, mortgage entities will be more aggressive in the purchase money market (mortgages necessary to purchase a home). There even seems to be recent evidence that lending standards are actually loosening.

Call Christie at 225-315-9003 or Christiefarris@gmail.com

Tuesday, February 25, 2014

Moving Up? Do it NOW not Later

A recent study revealed that the number of existing home owners

planning to buy a home this year is about to increase dramatically.

Some are moving up, some are downsizing and others are making a lateral

move. Another study shows that over 75% of these buyers will, in fact,

be in that first category: a move-up buyer. We want to address this

group of buyers in today’s blog post.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 13.8% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $341,400. But, the $400,000 home would now be worth $455,200 (requiring a mortgage of $409,680).

Here is a table showing what additional monthly cost would be incurred by waiting:

Prices are projected to appreciate by over 4% and interest rates are also expected to rise by as much as another full percentage point. If your family plans to move-up to a nicer or bigger home this year, it may make sense to move now rather than later.

Tuesday, February 4, 2014

5 Reasons to Buy Now Instead of Spring

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives:

Supply Is Shrinking

With inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.

Price Increases Are on the Horizon

Prices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.

Owning a Home Helps Create Family Wealth

Whether you are rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.

Interest Rates Are Projected to Rise

The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the this time next year. That is an increase of almost one full point over current rates.

Buy Low, Sell High

We would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.

Saturday, February 1, 2014

Are Mom & Dad Helping or Impeding Your Home Purchase?

Homebuyers, especially First Time Home Buyers,often get advice from family, friends and colleagues. Some of it is spot on, some of it may be well-intentioned but out of sync with the market the buyers are facing, versus what another's own experience was at some past point in time.

I find that many young buyers get help from family members either financially or practically. When family has a vested interest, it’s important to consider the part they play in the transaction. Most of my clients do want the ultimate approval of their parents, but also want to play a lead role in the home selection. Here are some scenarios that have arisen, and ideas for keeping all parties feeling good about the process.

Collaboration: Being a protective Mom myself, I can understand a parent’s desire to be watchful, making sure their kids are getting sound advice and not getting themselves in over their head. With permission from my buyer client, I offer to engage the parents in an initial meeting, either on a conference call or in person. One buyer did elect to have his mother on speakerphone while preparing his first written offer. After that, both Mom and son were confident moving forward.

Calming: Fear is evident in many of my First Time Buyer purchases, but typically it is more prominent in the parents than the kids. Past missteps and worry can let anxieties run high. Inviting parents to home inspections or including them on report findings often allows them to feel more comfortable with the home’s condition, or the ability to ask questions. Lots of times, parents offer to help with those smaller repair or maintenance items as they can see the excitement mounting in their offspring’s eyes.

Grounding: One Mom was very instrumental in keeping her daughter realistic about the gap between her dream home and her budget - the classic “champagne taste on a beer budget” scenario. But daughter was determined to buy a home of her own, even if that meant a fixer. Dad got cold feet when he saw the condition of homes in his daughter’s price range and did not want her to make a purchase at all. Once Mom saw what her daughter would actually get for her money, Mom & Dad decided to help out, allowing daughter to get a safer, and better-built option.

Educating: Another parent was helping financially and wanted his son to ‘get the best deal.’ In a low inventory, multiple-offer market, that wasn’t a realistic expectation. After their son lost out on several properties listening to purchase advice from his parents, Mom & Dad were copied on comp information for future purchases in order to help them understand why lower than asking price offers were costing money in the long run as prices increased on the next round of homes for sale.

I would never discourage anyone from including a family member whose advice is appreciated, especially if that person will be putting sweat equity or money into the equation. Bring all parties together early on can keep everyone feeling good about the outcome.

Monday, January 20, 2014

3 Questions to Ask Before Buying a Home

If

you are thinking about purchasing a home right now, you are surely

getting a lot of advice. Though your friends and family have your

best interests at heart, they may not be fully aware of your needs

and what is currently happening in real estate. Let’s look at

whether or not now is actually a good time for you to buy a home.

There

are three questions you should ask before purchasing in today’s

market:

1. Why am I buying a home in the first place?

This truly is the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with finances. A study by the Joint Center for Housing Studies at Harvard University reveals that the four major reasons people buy a home have nothing to do with money:- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of the space

2. Where are home values headed?

When looking at future housing values, we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.Here is what the experts projected in the latest survey:

- Home values will appreciate by 4.3% in 2014.

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the

survey still are projecting a cumulative appreciation of over 16.8%

by 2018.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by an increase in mortgage rates.The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase by approximately one full percentage over the next twelve months.

Bottom Line

Only you and your family can know for certain the right time to purchase a home. Answering these questions will help you make that decision.Sunday, January 19, 2014

Friday, January 17, 2014

Boomerang Buyers

“Boomerang buyers” are former homeowners who have gone through a

short sale, foreclosure, or bankruptcy in the past few years and are

saving up for a down payment to purchase a home again.

Friday, January 10, 2014

The Latest on Housing Affordability

The Latest on Housing Affordability

At the national level, housing affordability is up for the month due to a break in mortgage rates and home prices gains but affordability will be down for the year. What is affordability like in your market?

At the national level, housing affordability is up for the month due to a break in mortgage rates and home prices gains but affordability will be down for the year. What is affordability like in your market?

- Housing affordability is up for the month of November as mortgage rates and the median price for a single family home in the US decreased slightly from October. In spite of the decrease, the median single-family home price is up 9.4 % from last year keeping prices moving at a high year-over-year pace.

- As a result of higher home prices and mortgage rates that are up 25.1%, nationally, affordability is down from 203 in November 2012 to 170.3 in November 2013.

- Home prices are expected to slow down while inventory figures improve. Income levels are up and should help consumer confidence before rates begin to rise for the coming year.

- By region, affordability is up from one month ago in all regions. The Midwest had the biggest gain in affordability at 3.4%. From one year ago, affordability is down in all regions. The West saw the biggest decline in affordability as a result of having the largest price gain at 15.9 %.

- Mortgage rates are expected to increase as the Fed reduces bond purchases and eventually begins to tighten monetary policy. For a look at how the housing market might respond to a change in rates, I recommend this Stress Test by Chief Economist Lawrence Yun.

- What does housing affordability look like in your market? View the full data release here.

- The Housing Affordability Index calculation assumes a 20 percent down payment and a 25 percent qualifying ratio (principle and interest payment to income). See further details on the methodology and assumptions behind the calculation here.

Monday, December 16, 2013

Good News for Economy = Bad News for Rates

GOOD NEWS FOR THE ECONOMY = BAD NEWS FOR RATES

The economy is improving. As an example, the latest employment report showed that the unemployment rate hit a five-year low. We must realize that, as the economic news gets better, the government will consider whether or not to continue the programs they put in place to stimulate the economy. One such program is the Fed’s purchasing of assets which has led to historically low long-term mortgage rates.

Analysts at Capital Economics noted in a recent HousingWire article:

"The 203,000 increase in November's non-farm payrolls, along with the drop in the unemployment rate to a five-year low of 7.0%, gives the Fed all the evidence it needs to begin tapering its asset purchases at the next FOMC meeting later this month."

Whether such ‘tapering’ occurs this month or early next year is questionable. The fact that mortgage rates will spike when it does occur is more a guarantee.

Here are the thoughts of a few Fed presidents regarding whether it is in fact time to cut back on this stimulus program:

James Bullard, President of the Federal Reserve Bank of St. Louis

“To the extent that key labor market indicators continue to show cumulative improvement, the likelihood of tapering asset purchases will continue to rise. The Committee’s 2012 criterion of substantial improvement in labor markets gets easier and easier to satisfy on a cumulative basis as labor markets continue to heal…Based on labor market data alone, the probability of a reduction in the pace of asset purchases has increased.”

Richard Fisher, President of the Federal Reserve Bank of Dallas

“In my view, we at the Fed should begin tapering back our bond purchases at the earliest opportunity…I consider this strategy desirable on its own merit: I would feel more comfortable were we to remove ourselves as soon as possible from interfering with the normal price-setting functioning of financial markets.”

Jeffrey Lacker, President of the Federal Reserve Bank of Richmond

“I expect discussion about the possibility of reducing the pace of asset purchases. The key issue, in my view, is the extent to which the benefits of further monetary stimulus are likely to outweigh the costs.”

If you are thinking about purchasing a home, buying before the tapering will probably mean a lower mortgage interest rate than if you waited.

Call or text Christie Farris at 225-315-9003 or email me at Christiefarris@gmail.com

Tuesday, December 10, 2013

Harvard: 5 Financial Reasons to Buy a Home

Harvard: 5 Financial Reasons to Buy a Home

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Bottom Line

We realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.Wednesday, December 4, 2013

Finding the Right Home for You - Christie Farris

In my experience, a home isn't a dream home because of its room dimensions. It's about how you feel when you walk through the front door, and the way you can instantly envision your life unfolding there.

This is about more than real estate - it‘s about your life and your dreams.

I understand you are looking for a new home, and I want to be the real estate professional to help you. I work with each of my clients individually, taking the time to understand their unique needs and lifestyle, and I want to do the same for you.

It's incredibly fulfilling to know I am helping my clients open a new chapter of their lives. That's why I work so hard to not only find that perfect home, but also to handle every last detail of the purchase process.

I am so excited to get started on finding you the perfect home.

Sincerely,

CHRISTIE FARRIS

This is about more than real estate - it‘s about your life and your dreams.

I understand you are looking for a new home, and I want to be the real estate professional to help you. I work with each of my clients individually, taking the time to understand their unique needs and lifestyle, and I want to do the same for you.

It's incredibly fulfilling to know I am helping my clients open a new chapter of their lives. That's why I work so hard to not only find that perfect home, but also to handle every last detail of the purchase process.

I am so excited to get started on finding you the perfect home.

Sincerely,

CHRISTIE FARRIS

Monday, November 25, 2013

5 Reasons to Buy A Home Now Instead of Spring

5 Reasons to Buy A Home Now Instead of Spring

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying:

1. Supply Is Shrinking

With inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.

2. Price Increases Are on the Horizon

Prices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.

3. Owning a Home Helps Create Family Wealth

Whether you are rent or you own the home you are leaving in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.

4. Interest Rates Are Projected to Rise

The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the end of 2014. That is an increase of almost one full point over current rates.

5. Buy Low, Sell High

We would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.

Monday, November 18, 2013

Cost of Waiting to Purchase a Home

Last month, the Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac

all projected that mortgage interest rates will increase by about one

full percentage over the next twelve months. We also know that many

experts are calling for home prices to also increase over the next year.

What Does This Mean to a Buyer?

What Does This Mean to a Buyer?

Here is a simple demonstration of what

impact an interest rate increase would have on the mortgage payment of a

home selling for approximately $250,000 even if home prices don’t

increase:

Tuesday, October 29, 2013

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate