The Gallup organization just released their April Economy and Personal Finances Poll

which asked Americans to choose the best option for long term

investment. It was no surprise to us that real estate returned to the

top position over other investment categories (gold, stocks/mutual

funds, savings accounts/CDs and bonds).

Back in 2011, gold was the most popular long-term investment among

Americans. However, with the housing market improving across the U.S.

and home prices rising, more Americans now consider real estate the best

option for long-term investments.

Visit www.brandyfarris.com for thousands of homes in your area!

Monday, April 28, 2014

Tuesday, April 22, 2014

True Cost of Waiting to Buy a Home

Let’s say your 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

Or you could look at it this way:

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,764, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $112,932, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $112,932, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

The difference in payment is $313.70 PER MONTH!

That’s like taking a $10 bill and tossing it out the window EVERY DAY!Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (Average $2) with $12 left for lunch!

- There goes Friday Sushi Night! ($80 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $22,000 car for $313.00 per month.

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,764, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $112,932, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $112,932, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

Monday, April 21, 2014

Either Way, You're Still Paying a Mortgage

There are some people that have not purchased a home because they are

uncomfortable taking on the obligation of a mortgage. Everyone should

realize that, unless you are living with our parents rent free, you are

paying a mortgage - either your mortgage or your landlord’s.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

Thursday, April 17, 2014

Real Estate: This Spring Will Be Different

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

MILLENNIALS

Contrary to many reports, this age demographic is READY, WILLING and ABLE to become homeowners. As a matter of fact, the latest National Association of Realtors’ gender study revealed that the Millennial generation has recently accounted for a greater percentage of all buyers than any other generation.

BABY BOOMERS

As prices have risen, so has the equity in many homes across American. Homeowners, having been shackled to their house because of low or negative equity for the last several years, are again free to make a move without worrying about bringing cash to a closing table in order to sell. We believe this new-found freedom will release a pent-up demand of sellers who want to move-up to the home they’ve always dreamed of or want to downsize their primary residence and also purchase a second home they can use for vacation, retirement or both.BOTH PRICES and MORTGAGE RATES are on the RISE

As the economy improves, more and more Americans are regaining faith that their ownpersonal finances are headed in a positive direction. With this new confidence, they want to take advantage of the opportunity that presents itself with real estate still undervalued in most parts of the country and mortgage rates being well below historic numbers.

Wednesday, April 16, 2014

Current Mortgage Rates Won't Last Forever..

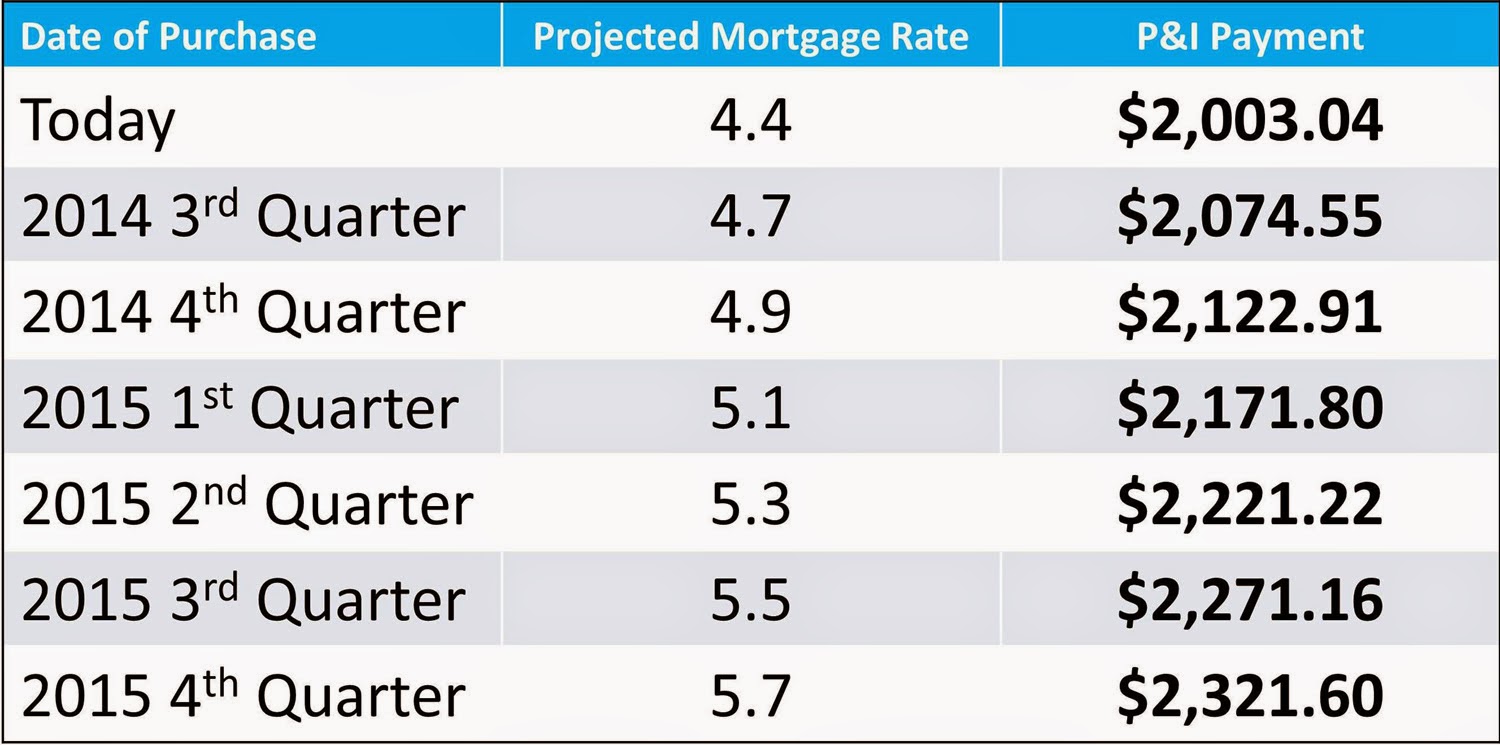

According to FreddieMac, the interest rate for a 30 year fixed rate mortgage at the beginning of April was 4.4%. However, FreddieMac predicts that mortgage rates will steadily climb over the next six quarters.

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Monday, April 14, 2014

Want to Sell Your House? Price it Right!

The housing market is recovering nicely. Prices have increased

nationally by double digits over the last twelve months. Competition

from the shadow inventory of lower priced distressed properties

(foreclosures and short sales) is diminishing rapidly. Now may be the

perfect time to sell your home and move to the dream house or beautiful

location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

Friday, April 11, 2014

Baton Rouge Residential Real Estate Market "ON FIRE"

Big gains in sales of homes priced at $300,000

and above over the past year have the Greater Baton Rouge residential

market "on fire" right now, says Tom Cook, who was among the presenters

at today's TRENDS in Real Estate Seminar.

Sales of homes priced above $400,000

saw a particularly significant increase of 55% between March of last

year and February, Cook said, while new home sales between $300,000 and

$400,000 also rose by 37% over the same time frame.

"Still, the bulk of the market is in the

smaller home market," said Cook, of Cook, Moore & Associates, who

estimates sales of homes below $300,000 account for approximately 77% of

total sales in the market.

Sales of homes priced between $225,00

and $300,000 were up 33% between March of last year and February, while

those priced between $100,000 and $225,000 were up just shy of 9%.

Taking a broader look at residential

trends, Cook noted the eight-parish Capital Region market represented by

the Greater Baton Rouge Association of Realtors saw a 15% increase in

total number of sales in 2013—which built upon a 14% increase during the

year previous. Total sales volume increased 19% last year, while the

average sales price rose 3.36% in 2013 and the average number of days a

home sat on the market before selling dropped from 123 to 86.

Still, Ty Gose of NAI/Latter & Blum assured the nearly 700 attendees of today's half-day seminar that the market will be able to absorb the additional apartments and condos. "Based on what the national experts are saying, we're not overbuilding," he says.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate