Selling Your Home During the Holidays?

Now is the

Time!

In today’s competitive real estate market, sometimes the

standard, run-of-the-mill open houses aren’t yielding much success,

and some sellers are choosing an alternative and effective method,

that has been dubbed, “extreme open houses.”

With catered refreshments, prizes and entertainment, these events

are causing quite a stir in the real estate world. By that, we mean

that sellers are throwing elaborate parties in the guise of an open

house, with hope that someone will buy their home. Some sellers hire

local musicians and throw a fully catered party, equipped with

champagne and expensive hors d’oeuvres. During the holidays, people

are in a festive mood, and throwing a party is always a good idea to

draw their attention.

The biggest advantage of an extreme open house is that potential

buyers can see your home in a different light, giving you a chance to

display some of your home’s attractive features. For example, if

you are cooking food at your party, your guests can focus on your

kitchen. Or, if you’re throwing a barbeque, you can get a chance to

show off your favorite patio, drawing attention to some of your

home’s best selling points.

Instead of showing a cold, empty home, you can attract potential

buyers with a warm and vibrant home full of nice furnishings.

Throwing a party in a warm and inviting home is a good idea even when

you invite people who don’t intend to buy your home, since many of

them will tell their friends about it.

Keep it simple

You don’t really need to throw an elaborate party to draw

peoples’ attention, however, you can offer them some nice snacks

and a glass of wine, giving them a chance to relax in the living room

or the patio, and enjoy some of the comforts of your home. For

starters, you can make a list of friends and acquaintances, and then

send out some flyers with your contact information and a few facts

about your home.

Are the holidays a good time to sell?

Although the holiday season isn’t really considered the best

time to sell, the real estate market is much tighter, resulting in

less competition for sellers. At the same time, motivated buyers are

still in the market for homes, in hopes that they can make a

purchase.

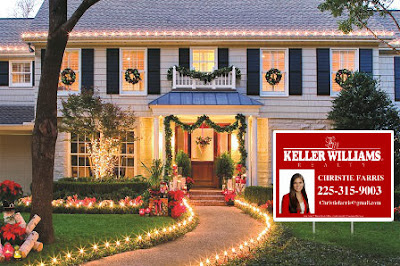

During the holidays, you can liven up your home with some lights

and ornaments to attract buyers. Although you can make your home

“shine” during the holidays, try not to overdo it. Homes often

look their best during the holidays, but sellers should be careful

not to overdo it on the decor. Too many ornaments could have a

negative effect, and actually turn buyers away. Obviously, you don’t

want to offend people, so be sure to go with tasteful decorations, as

opposed to large and gaudy ones.

Also keep in mind that emotions play a big role in homebuyer

purchases. A well organized home with a few tasteful decorations

shows much better than a cluttered home with your kid’s toys lying

around the living room. People will often purchase a home solely

based on their gut feelings. If a buyer “falls in love” with your

home, chances are they’re going to be more inclined to purchase it.

On a final note, it’s also a good idea to make it easy for

people to stop by to see your home. In this case, flexibility is a

key factor. People are busy during the holidays, and the chances of

selling your home will be much greater if make it available for them

to see.

Despite the fact that many people feel that the holidays aren’t

a good time to buy or sell a home, this really isn’t the case. With

a little knowledge and effort, you can sell your home in a timely

manner, relax, and enjoy the Holidays!

Call Your Local Real Estate Professional

CHRISTIE FARRIS

225-315-9003

CHRISTIEFARRIS@GMAIL.COM

http://www.christiefarris.com