Sales of new homes in U.S. hit 5-year high in January

U.S. sales of new homes rebounded in January to the fastest pace in more than five years, offering hopes that housing could be regaining momentum after a slowdown last year caused by rising interest rates. The Associated Press reports sales of new homes increased 9.6% in January to a seasonally adjusted annual rate of 468,000, citing a Commerce Department report issued this morning

Wednesday, February 26, 2014

Tuesday, February 25, 2014

Moving Up? Do it NOW not Later

A recent study revealed that the number of existing home owners

planning to buy a home this year is about to increase dramatically.

Some are moving up, some are downsizing and others are making a lateral

move. Another study shows that over 75% of these buyers will, in fact,

be in that first category: a move-up buyer. We want to address this

group of buyers in today’s blog post.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

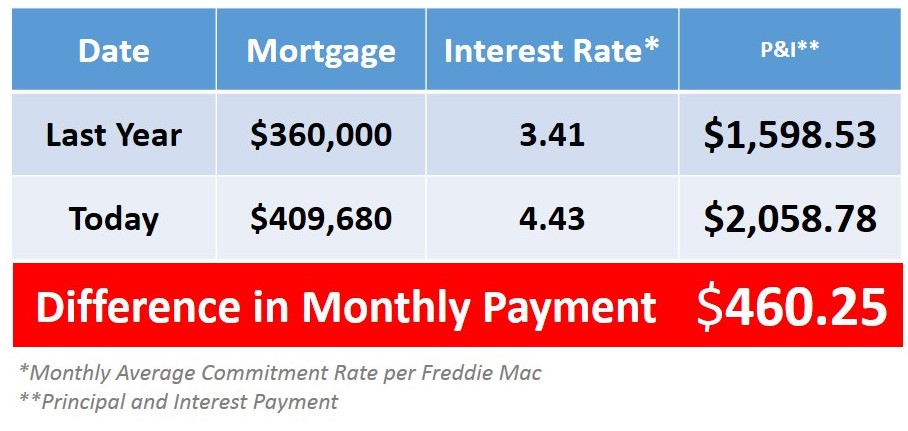

Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 13.8% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $341,400. But, the $400,000 home would now be worth $455,200 (requiring a mortgage of $409,680).

Here is a table showing what additional monthly cost would be incurred by waiting:

Prices are projected to appreciate by over 4% and interest rates are also expected to rise by as much as another full percentage point. If your family plans to move-up to a nicer or bigger home this year, it may make sense to move now rather than later.

Monday, February 24, 2014

Should you Buy or Rent?

Here is one simple chart that explains why buying a home makes more sense than renting one.

Call me today for a free first time home buyer guide.

Friday, February 21, 2014

Rises in Housing Inventories Offer Some Relief to Buyers

Rises in Housing Inventories Offer Some Relief to Buyers

The 2014 home buying season is off to a strong start with

year-over-year increases in housing inventories and “sustained growth in

home prices,” according to the latest National Housing Trend Report

from realtor.com®, which reflects data of 143 markets across the

country.

The number of properties for sales edged up 3.1 percent in January

while the median age of inventory basically held steady, indicating a

“less frenzied market” than in January 2013, realtor.com® reports.

This is “an encouraging sign of sellers’ interest, particularly given

the adverse conditions brought on by the polar vortex,” says Errol

Samuelson, realtor.com®’s president. “We saw the tight-supply market of

last fall carry all the way into November – later than is typically

expected – and this early rise in inventory is a welcome trend.”

The 2014 home buying season is off to a strong start with

year-over-year increases in housing inventories and “sustained growth in

home prices,” according to the latest National Housing Trend Report

from realtor.com®, which reflects data of 143 markets across the

country.

The number of properties for sales edged up 3.1 percent in January

while the median age of inventory basically held steady, indicating a

“less frenzied market” than in January 2013, realtor.com® reports.

This is “an encouraging sign of sellers’ interest, particularly given

the adverse conditions brought on by the polar vortex,” says Errol

Samuelson, realtor.com®’s president. “We saw the tight-supply market of

last fall carry all the way into November – later than is typically

expected – and this early rise in inventory is a welcome trend.”

Cut the Cost of Maintaining your Home

Upgrade to lower costs

Homeowners once had to make a choice: the beauty of genuine wood and stone, or the easy maintenance of a man-made alternative. Installing

vinyl siding over wood shingles, for example, meant you'd never have to

repaint again, but also required sacrificing architectural charm -- and

possibly getting kicked off your neighbor's dinner party guest list. Now,

though, you can have it all. A new breed of manufactured products

available at home centers and specialty shops looks realistic enough to

preserve or even boost your home's appearance.

While some of these modern materials are pricier than the natural versions, they will save you money and effort over the long term. Plus, "it's a compelling one-two punch for selling," says Lake Forest, Ill., realtor Carol Russ. "The traditional looks draw buyers in, and then I tell them that they're actually seeing new, super-durable materials." Here are six imitations that might be better than the real deal.

1. FIBER-CEMENT SIDING

2. CELLULAR PVC TRIM

3. QUARTZ COUNTERTOPS

4. SOLID VINYL FENCING

5. FIBERGLASS ENTRY DOORS

6. CLAD WINDOWS

While some of these modern materials are pricier than the natural versions, they will save you money and effort over the long term. Plus, "it's a compelling one-two punch for selling," says Lake Forest, Ill., realtor Carol Russ. "The traditional looks draw buyers in, and then I tell them that they're actually seeing new, super-durable materials." Here are six imitations that might be better than the real deal.

1. FIBER-CEMENT SIDING

2. CELLULAR PVC TRIM

3. QUARTZ COUNTERTOPS

4. SOLID VINYL FENCING

5. FIBERGLASS ENTRY DOORS

6. CLAD WINDOWS

Questions to Ask your Lender

When you ask the questions below, listen carefully to see if the lender

is answering in a straightforward way, without using jargon you don't

understand. When you ask about fees, do they include them all

voluntarily? If you think they are trying too hard to push you in a

certain direction, go elsewhere.

About the Lender

- Are you licensed by the state?

- Whom do you represent (e.g., a bank, broker, finance company)?

- What are your loan programs? Do you offer VA loans (for example)?

- What is the par rate (the actual rate for a particular loan) for a 30-year fixed loan? (He should have the answer at the tip of his tongue.)

- Can you estimate and explain your fees?

- Are you going to hold this loan or sell it?

Additional Questions for Lenders:

- Is there someone I can talk to whenever I need to?

- How are you keeping my personal information secure?

- Do you sell my information?

Additional Questions for Mortgage Brokers:

- How do you get paid?

- How much will you make on this loan?

- Who are some of your top lenders (lenders who purchase the loan applications from the broker)?

About the Loan

- What is the interest rate you are offering, and how did you arrive at it?

- How do I know this is the best rate?

- How will the rate change over the life of the loan?

- If an adjustable-rate mortgage (ARM), what is the worst-case scenario I could face when the rate resets?

- Are you locking in my rate? For how long? What does the lock cost me?

- Could you estimate closing costs for my loan?

- Can you explain an APR, and what is it for this loan?

- What am I paying in points?

- What are my monthly payments?

- Do I need to pay private mortgage insurance (PMI?)

- Are there any prepayment penalties on this loan?

- For a reverse mortgage, who will I be working with after closing?

- Here's my timeline. Are you certain you can get this done in time for closing?

Tuesday, February 18, 2014

CAPITAL REGION HOME SALES UP 8.6% TO OPEN 2014

CAPITAL REGION HOME SALES UP 8.6% TO OPEN 2014

Home sales in the eight-parish Capital Region were up 8.6% in January compared to the opening month of last year, suggesting the local housing market continues to build upon the momentum it had at the end of 2013. Home sales at the end of last year were 15% higher than total sales during 2012—aided by an 18.1% rise in December. Though January’s year-over-year sales increase is not quite as high, the monthly report from the Greater Baton Rouge Association of Realtors, released today, includes many positive figures.

Home sales in the eight-parish Capital Region were up 8.6% in January compared to the opening month of last year, suggesting the local housing market continues to build upon the momentum it had at the end of 2013. Home sales at the end of last year were 15% higher than total sales during 2012—aided by an 18.1% rise in December. Though January’s year-over-year sales increase is not quite as high, the monthly report from the Greater Baton Rouge Association of Realtors, released today, includes many positive figures.

Mortgage Rates Projected to Rise as Tapering Continues

It is projected that if the Fed continues to cut back on bond purchases that long term mortage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.

However in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

“In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.”

What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:

However in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

“In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.”

What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:

Monday, February 17, 2014

More Americans Confident about Home Buying

Last week, Fannie Mae released their January 2014 National Housing Survey results. Two categories reported all-time survey highs.

“A majority of consumers now believe that it is getting easier to get a mortgage. For the first time in the National Housing Survey’s three-and-a-half-year history, the share of respondents who said it is easy to get a mortgage surpassed the 50-percent mark. The gradual upward trend in this indicator during the last few months bodes well for the housing recovery and may be contributing to this month’s increase in consumers’ intention to buy rather than rent their next home. The dip in overall home price expectations, though notable, is consistent with our view of moderating home price gains this year from a robust pace last year, while positive trends in perceptions about the economy and personal finances over the next year support our view of stronger growth in the broader economy.”

With home prices projected to increase in 2014 (albeit at a slower pace than they did in 2013) and with mortgage interest rates projected to increase, it is good news that consumers are becoming more confident in their ability to buy a home if they so desire.

If you are looking to buy or sell a home:

call Christie Farris at 225-315-9003 or email at Christiefarris@gmail.com

- 52% of respondents thought it would be easy for them to get a home mortgage today

- 70% of respondents said they would buy if they were going to move

“A majority of consumers now believe that it is getting easier to get a mortgage. For the first time in the National Housing Survey’s three-and-a-half-year history, the share of respondents who said it is easy to get a mortgage surpassed the 50-percent mark. The gradual upward trend in this indicator during the last few months bodes well for the housing recovery and may be contributing to this month’s increase in consumers’ intention to buy rather than rent their next home. The dip in overall home price expectations, though notable, is consistent with our view of moderating home price gains this year from a robust pace last year, while positive trends in perceptions about the economy and personal finances over the next year support our view of stronger growth in the broader economy.”

With home prices projected to increase in 2014 (albeit at a slower pace than they did in 2013) and with mortgage interest rates projected to increase, it is good news that consumers are becoming more confident in their ability to buy a home if they so desire.

call Christie Farris at 225-315-9003 or email at Christiefarris@gmail.com

Tuesday, February 11, 2014

Buying a Home? Should you do it Now or Later?

Buying a Home? Should you do it Now or Later?

Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.

Interest rates have remained relatively stable since the onset of the tapering in December. This is probably because the first round of increases had already been ‘priced into’ the equation last summer when rates skyrocketed by over a full percentage point just on the speculation that tapering would take place later in 2013.

However, as we move forward, most analysts believe rates will start to rise culminating in a rate close to a full percentage point higher than current rates by this time next year. For example, Freddie Mac, Fannie Mae, The Mortgage Bankers’ Association and the National Association of Realtors have all recently projected rates to be between 5-5.4% at this time next year.

Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.

Interest rates have remained relatively stable since the onset of the tapering in December. This is probably because the first round of increases had already been ‘priced into’ the equation last summer when rates skyrocketed by over a full percentage point just on the speculation that tapering would take place later in 2013.

However, as we move forward, most analysts believe rates will start to rise culminating in a rate close to a full percentage point higher than current rates by this time next year. For example, Freddie Mac, Fannie Mae, The Mortgage Bankers’ Association and the National Association of Realtors have all recently projected rates to be between 5-5.4% at this time next year.

Bottom Line

If you are a first time buyer or a move-up buyer, the cost of the mortgage on your new home will probably increase as we move through the year. If the timing makes sense, buying sooner rather than later may save you a substantial amount of money over the long term in lower mortgage payments.Monday, February 10, 2014

Forget Diamonds: Down Payments Are a Girl's Best Friend

Forget Diamonds: Down Payments Are a Girl's Best Friend

by Michele Lerner Feb 10th 2014 10:08AM

But before you hire a skywriter or horse-drawn carriage, or wow your sweetie with diamond jewelry, be sure that you know what your beloved really wants. Because, it turns out, sparkly signs of affection like may be lower down the list than you thought.

A recent survey by ERA Real Estate of 1,000 people in committed relationships showed that nearly 50 percent of women would be willing to forgo a diamond ring in order to save the cash for a down payment on a house. In fact, 18 percent of those who responded said they already had skipped the ring in favor of the house. And 89 percent of those surveyed said that their love bond was strengthened by buying a home together.

How Much Cash Are We Talking About?

So, exactly how much house could a diamond buy? Let's use the most common piece of jewelry -- the diamond engagement ring -- for our comparison.

According to TheKnot.com and WeddingChannel.com's 2013 survey, the average diamond engagement ring costs $5,431. And, according to National Association of Realtors' data, the national median existing-home price for all of 2013 was $197,100.

So a 5 percent down payment on that median house would be $9,855, and forgoing the average engagement ring would you more than halfway there.

Not Everyone's Willing to Give Up the Bling

One interesting finding from the ERA survey shows that there's a bit of a generation gap when it comes to deferring diamonds in favor of down payment money.

While 50 percent of women in their 20s would choose the home rather than diamonds, only 8 percent of women in their 50s and only 2 percent of women in their 60s would give up the bling.

Are older women more sentimental? Maybe. Or perhaps they're already living in their dream homes (or have the down payment question squared away, either in liquid assets or home equity) and would prefer a more traditional show of affection on Valentine's Day.

Michele Lerner is a Motley Fool contributing writer.

Wednesday, February 5, 2014

5 Reasons you Shouldn't For Sale By Owner

Some homeowners consider trying to sell their home on their own,

known in the industry as a For Sale by Owner (FSBO). We think there are

several reasons this might not be a good idea for the vast majority of

sellers.

Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.

Here are five reasons:

1. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to FSBO.- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies which work for the buyer and will almost always find some problems with the house

- The appraiser if there is a question of value

- Your bank in the case of a short sale

2. Exposure to Perspective Purchasers

Recent studies have shown that 92% of buyers search online for a home. That is in comparison to only 28% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?3. Results Come from the Internet

Where do buyers find the home they actually purchased?- 43% on the internet

- 9% from a yard sign

- 1% from newspapers

4. FSBOing has Become More and More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 9% over the last 20+ years.5. You Net More Money when Using an Agent

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real commission. The seller and buyer can’t both save the commission.Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.

Bottom Line

Before you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer.Tuesday, February 4, 2014

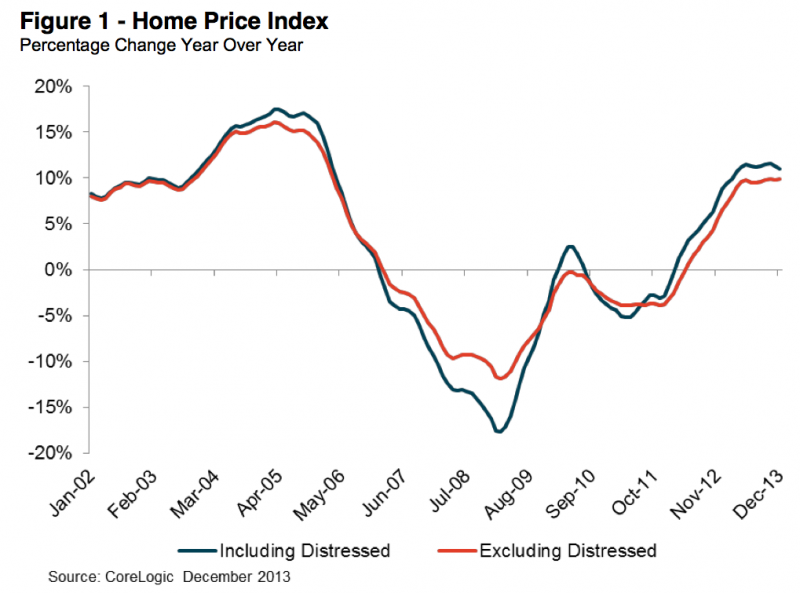

US Home Prices Rise For The 22nd Straight Month

US Home Prices Rise For The 22nd Straight Month

Christie Farris

#1 Louisiana Realtor

225-315-9003

Christiefarris.com

www.christiefarris.com

Christie Farris

#1 Louisiana Realtor

225-315-9003

Christiefarris.com

www.christiefarris.com

5 Reasons to Buy Now Instead of Spring

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives:

Supply Is Shrinking

With inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.

Price Increases Are on the Horizon

Prices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.

Owning a Home Helps Create Family Wealth

Whether you are rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.

Interest Rates Are Projected to Rise

The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the this time next year. That is an increase of almost one full point over current rates.

Buy Low, Sell High

We would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.

Saturday, February 1, 2014

Are Mom & Dad Helping or Impeding Your Home Purchase?

Homebuyers, especially First Time Home Buyers,often get advice from family, friends and colleagues. Some of it is spot on, some of it may be well-intentioned but out of sync with the market the buyers are facing, versus what another's own experience was at some past point in time.

I find that many young buyers get help from family members either financially or practically. When family has a vested interest, it’s important to consider the part they play in the transaction. Most of my clients do want the ultimate approval of their parents, but also want to play a lead role in the home selection. Here are some scenarios that have arisen, and ideas for keeping all parties feeling good about the process.

Collaboration: Being a protective Mom myself, I can understand a parent’s desire to be watchful, making sure their kids are getting sound advice and not getting themselves in over their head. With permission from my buyer client, I offer to engage the parents in an initial meeting, either on a conference call or in person. One buyer did elect to have his mother on speakerphone while preparing his first written offer. After that, both Mom and son were confident moving forward.

Calming: Fear is evident in many of my First Time Buyer purchases, but typically it is more prominent in the parents than the kids. Past missteps and worry can let anxieties run high. Inviting parents to home inspections or including them on report findings often allows them to feel more comfortable with the home’s condition, or the ability to ask questions. Lots of times, parents offer to help with those smaller repair or maintenance items as they can see the excitement mounting in their offspring’s eyes.

Grounding: One Mom was very instrumental in keeping her daughter realistic about the gap between her dream home and her budget - the classic “champagne taste on a beer budget” scenario. But daughter was determined to buy a home of her own, even if that meant a fixer. Dad got cold feet when he saw the condition of homes in his daughter’s price range and did not want her to make a purchase at all. Once Mom saw what her daughter would actually get for her money, Mom & Dad decided to help out, allowing daughter to get a safer, and better-built option.

Educating: Another parent was helping financially and wanted his son to ‘get the best deal.’ In a low inventory, multiple-offer market, that wasn’t a realistic expectation. After their son lost out on several properties listening to purchase advice from his parents, Mom & Dad were copied on comp information for future purchases in order to help them understand why lower than asking price offers were costing money in the long run as prices increased on the next round of homes for sale.

I would never discourage anyone from including a family member whose advice is appreciated, especially if that person will be putting sweat equity or money into the equation. Bring all parties together early on can keep everyone feeling good about the outcome.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate