- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house.

- The termite company if there are challenges

- The buyer’s lender if the structure of the mortgage requires the sellers’ participation

- The appraiser if there is a question of value

- The title company if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality if you need to get the COs permits mentioned above

- The buyer’s buyer in case there are challenges on the house your buyer is selling

- Your bank in the case of a short sale

Wednesday, December 30, 2015

Selling on your own? Get ready to negotiate!

Now that the market has shown signs of recovery, some sellers may be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. Real estate agents are trained and experienced in negotiation. In most cases, the seller is not. The seller must realize their ability to negotiate will determine whether they can get the best deal for themselves and their family. Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

Tuesday, December 22, 2015

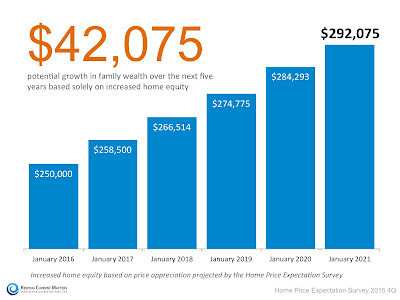

Building Family Wealth Over the Next 5 Years - Real Estate

As the economy continues to improve, more and more Americans are seeing their personal financial situations also improving. Instead of just getting by, many are now beginning to save and find other ways to build their net worth. One way to dramatically increase their family wealth is through the acquisition of real estate.

For example, let’s assume a young couple purchases and closes on a $250,000 home in January. What will that home be worth five years down the road?

Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists every quarter. They ask them to project how residential prices will appreciate over the next five years. According to their latest survey, here is how much value that $250,000 house will gain in the coming years.

Over a five year period, that homeowner can build their home equity to over $40,000. And, in many cases, home equity is large portion of a family’s overall net worth.

Bottom Line

If you are looking to better your family’s long-term financial situation, buying your dream home might be a great option.

Friday, December 4, 2015

The Difference your Interest Rate Makes

Some Highlights:

- Interest rates have come a long way in the last 30 years.

- The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford.

- Experts predict that rates will increase by 3/4 a percent over the next 12 months.

- Secure a low rate now to get the most house for your money.

Wednesday, November 18, 2015

How to Get the Most Money from the Sale of Your House

Every homeowner wants to make sure they maximize the financial reward when selling their home. But, how do you guarantee that you receive maximum value for your house? Here are two keys to insuring you get the highest price possible.

1. Price it a LITTLE LOW

This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In actuality, this just dramatically lessens the demand for your house. (see chart)

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so demand for the home is maximized. In that way, the seller will not be fighting with a buyer over the price but instead will have multiple buyers fighting with each other over the house.

In a recent article on realtor.com, they gave this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This too may seem counterintuitive. The seller may think they would net more money if they didn’t have to pay a real estate commission. Yet, studies have shown that typically homes sell for more money when handled by a real estate professional.

Recent research posted by the Economists’ Outlook Blog revealed:

“The median selling price for all FSBO homes was $210,000 last year. When the buyer knew the seller in FSBO sales, the number sinks to the median selling price of $151,900. However, homes that were sold with the assistance of an agent had a median selling price of $249,000 – nearly $40,000 more for the typical home sale.”Bottom Line

Price it at or slightly below the current market value and hire a professional. That will guarantee you maximize the price you get for your house.Friday, November 6, 2015

Metro Baton Rouge home sales jump in September

http://theadvocate.com/news/13896036-123/metro-baton-rouge-home-sales

The number of houses sold in metro Baton Rouge rose 15.4 percent in September from a year ago, thanks to a big boost in activity in East Baton Rouge Parish.

There were 883 homes sold in September in the nine-parish area, according to figures released Thursday by the Greater Baton Rouge Association of Realtors’ Multiple Listing Service. That compares with 765 MLS sales in September 2014. This was the fourth month in a row sales have gone up year-to-year.

East Baton Rouge Parish, which makes up the largest share of MLS sales, had the biggest gain in closings. There were 473 homes sold in the parish during September, a 24.1 percent increase over the 381 MLS sales in September 2014.

Wynona Squires, broker/owner of Re/Max First in Baton Rouge, said indications that the Federal Reserve may raise interest rates in the near future “has put some urgency” on first-time homebuyers in the market.

“We’ve been very busy through the summer,” said Squires, a member of the Greater Baton Rouge Association of Realtors’ board of directors. “A lot of my agents have numbers that are larger than what they were last year.”

According to MLS figures provided by Squires, much of the increased sales activity was in the starter-home market. There were 99 homes sold in East Baton Rouge Parish in September in the $150,000 to $199,999 range. That was a 48 percent increase over the 67 sales in September 2014 in the same price bracket. More expensive homes were also moving, with the number of home sales in the $300,000 to $349,999 range increasing by 68 percent to 32. The number of sales in the $600,000 to $699,999 range went from two in September 2014 to seven a year later.

Livingston Parish had an 18.3 percent increase in sales during September, jumping from 153 MLS sales in 2014 to 181 sales.

Ascension Parish, which has been hampered by a lack of inventory, had a 6.5 percent increase in MLS sales. There were 163 sales in September, compared with 153 a year earlier.

The median home sales price in the area rose by 6.1 percent in September to $188,000 from $177,250 — meaning half the houses sold for more and half for less than that price.

The number of pending sales in metro Baton Rouge, a sign of future activity, decreased by 3.3 percent from 800 to 774.

The number of homes for sale dropped by 11.2 percent from 4,183 in September 2014 to 3,713. New listings were up by 15.8 percent to 1,077 in September, compared with 930 a year earlier.

Although the local housing market has performed well this year, with rising prices and increased sales activity, a lack of housing inventory has put a damper on the market.

The supply in months was 4.6, based on the current rate of sales, compared with 5.5 months in September 2014. Six months is considered an ample supply.

The number of days a house stayed on the market dropped from 83 to 67 in metro Baton Rouge.

Through the first nine months of 2015, there were 7,537 home sales in the metro area, compared with 6,915 through September 2014, a 9 percent increase.

Saturday, August 15, 2015

Gorgeous New Listing! Custom Built Home in Green Trails. Built 2013.

CALL OR TEXT CHRISTIE FARRIS AT 225-315-9003 FOR MORE DETAILS OR TO SCHEDULE A SHOWING. Gorgeous 2 year old custom built home features an open floor plan, high ceilings, beautiful hand scraped wood flooring, gas fireplace, and beautiful cypress cabinetry throughout. Tons of windows create lots of natural light through out. Spacious and open gourmet kitchen with a huge island, 3 cm granite countertops, stainless steel appliances, gas stove, the convenient pot-fill, large ceramic tile flooring, and sitting/breakfast area. Large master suite. Master bathroom features his and her separate vanities, large whirlpool tub, tall custom shower, huge amount of closet space, and ceramic tile flooring. Every bathroom in the home has granite countertops. The fourth bedroom located on the other side of the home could be used as a mother in law suite. Down the hallway is a computer nook perfect for office or school work. Two car garage with extra storage space. The covered back porch is equipped with a top of the line outdoor kitchen perfect for entertaining. Tree lined back yard bordered by a tall wood privacy fence. Don't miss out on this great new listing. Home built 2013.

http://www.zillow.com/homedetails/15739-Parkside-Ct-Baton-Rouge-LA-70817/119321468_zpid/

Tuesday, August 11, 2015

Monday, July 20, 2015

Why You Need to Hire a Realtor

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of higher mortgage interest rates & home prices as the market continues to recover.

1. What do you do with all this paperwork? Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what? According to the Orlando Regional REALTOR Association, there are over 230 possible actionsthat need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream.

3. Are you a good negotiator? So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth? It is important for your home to be priced correctly from the start to attract the right buyers and shorten the time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to the National Association of REALTORS, “the typical FSBO home sold for $208,700 compared to $235,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market? There is so much information out there on the news and the internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer? Dave Ramsey, the financial guru advises:

Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of higher mortgage interest rates & home prices as the market continues to recover.

1. What do you do with all this paperwork? Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what? According to the Orlando Regional REALTOR Association, there are over 230 possible actionsthat need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream.

3. Are you a good negotiator? So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth? It is important for your home to be priced correctly from the start to attract the right buyers and shorten the time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to the National Association of REALTORS, “the typical FSBO home sold for $208,700 compared to $235,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market? There is so much information out there on the news and the internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer? Dave Ramsey, the financial guru advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line:

You wouldn’t replace the engine in your car without a trusted mechanic. Why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional?Thursday, July 16, 2015

HomeOwnership - The Key to Well-Being in Retirement

The data proves that homeownership has a big role in building wealth for American families.

In recently released study by the Hamilton Project, Ten Economic Facts about Financial Well-Being in Retirement, it was revealed that:

1. Middle-class households near retirement age have about as much wealth in their homes as they do in their retirement accounts.

“Over the past quarter century the largest single source of wealth for all but the richest households nearing retirement age has been their homes, which accounted for about two-fifths of net worth in the early 1990s and accounts for about one-third today.”

2. Home equity is a very important source of net worth to all but the wealthiest households near retirement age.

“Home equity is an important source of wealth for middle income households, accounting for more than one-third of total net worth for the second, third, and fourth quintiles of the net worth distribution… The fifth quintile has a much larger share in business equity—almost a quarter—than any other quintile. (The figure leaves out the bottom quintile of households because they have negative net worth. It is likely that these households will rely almost exclusively on Social Security in retirement.)”

Here is an asset breakdown for the middle 20% of Americans determined by median net worth ($165, 720):

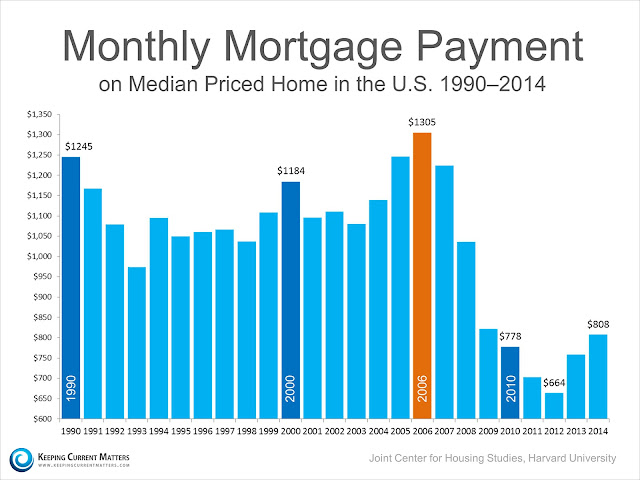

The Main Reason You Should NOT Wait to Buy a Home

The Joint Center for Housing Studies at Harvard University recently released their 2015 State of the Nation’s Housing report. The report concentrated on the challenges renters in this country are facing because of the diminishing supply of quality rental units and dramatically escalating rents.

However, there was also information buried within the report that revealed that now is definitely the time to buy your first home or move-up to the home of your family’s dreams. With home prices still below peak values and mortgage rates still near historic lows, the monthly mortgage payment on a median priced home is less than at almost any time in the last 25 years.

With home prices increasing and mortgage rates projected to increase, now is the time to buy.

Here is a graph which helps visualize the data from the report:

Tuesday, July 14, 2015

What If I Wait Until Next Year to Buy a Home?

First-time homebuyers are flocking to the housing market in greater numbers than any time in the last few years. Renters who are ready and willing to buy are now realizing that they are also able to as well. Many first-time buyers are Millennials (born between 1981 – 1997). If you are one of the many in this generation who sees your friends and family diving head first into the real estate market, and wonder if now is the time for you to do the same, keep reading! The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time. Let’s look at an example of what the experts are predicting for the upcoming year, and what that really would mean for you. Let’s say you’re 30 and your dream house costs $250,000 today. Right now mortgage interest rates are at or about 4%.

But you’re busy, you like your apartment, and moving is such a hassle. You decide to wait until next year to buy. CoreLogic predicts that home prices will appreciate by 5.1% in the next 12 months; this means that same house you loved now costs, $262,750. Freddie Mac predicts that over this same period of time, interest rates will be a full point higher at 5.0%. Your new payment per month is now $1,410.50.

That’s basically like taking $8 and tossing it out the window EVERY DAY! Or you could look at it this way:

Your monthly mortgage payment (principal & interest only) would be $1,193.54.

The difference in payment is $216.96 PER MONTH!

- That’s your morning coffee everyday on the way to work (average $2) with $10 left for lunch!

- There goes Friday Sushi Night! ($50 x 4)

- Stressed Out? How about a few deep tissue massages with tip!

- Need a new car? You could get a brand new car for $217 a month.

Tuesday, July 7, 2015

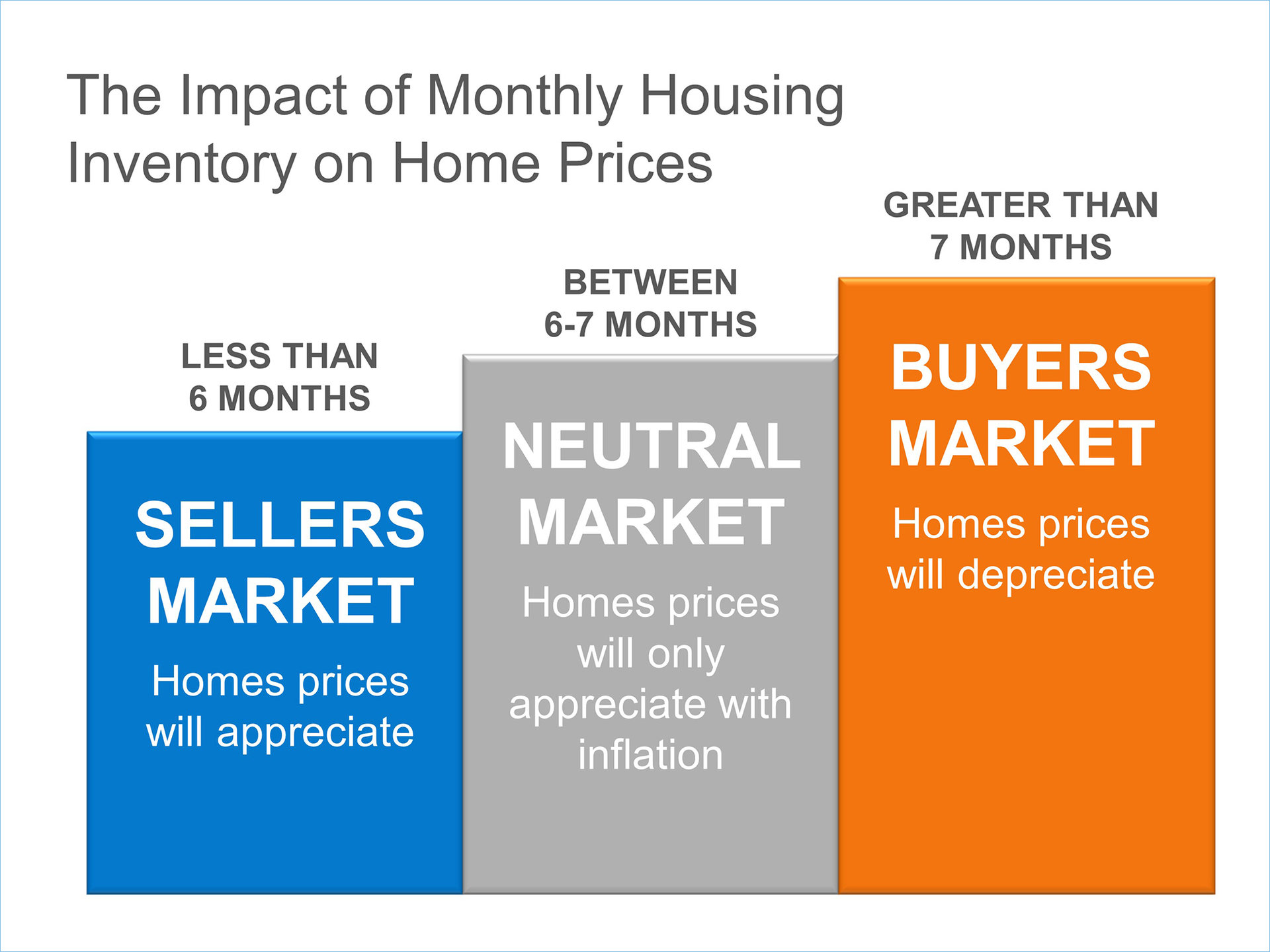

#1 Reason To Sell Your Home Now

If you are one of the many homeowners out there who are debating putting their house on the market this year, don’t miss out on the great opportunity you have right now!

The latest Existing Home Sales Report from The National Association of Realtors (NAR), reveals that the inventory of homes for sale has dropped to a 5.1-month supply.

Historically, a 6-month supply is necessary for a ‘normal’ market, explained below:

There are more buyers that are ready, willing and able to buy now, than there has been in years! The supply of homes for sale is not keeping up with the demand of these buyers.

Bottom Line

Home prices are appreciating in this seller’s market. Listing now will give you the most exposure to buyers who will be competing against each other to buy your house.

Friday, July 3, 2015

Thursday, July 2, 2015

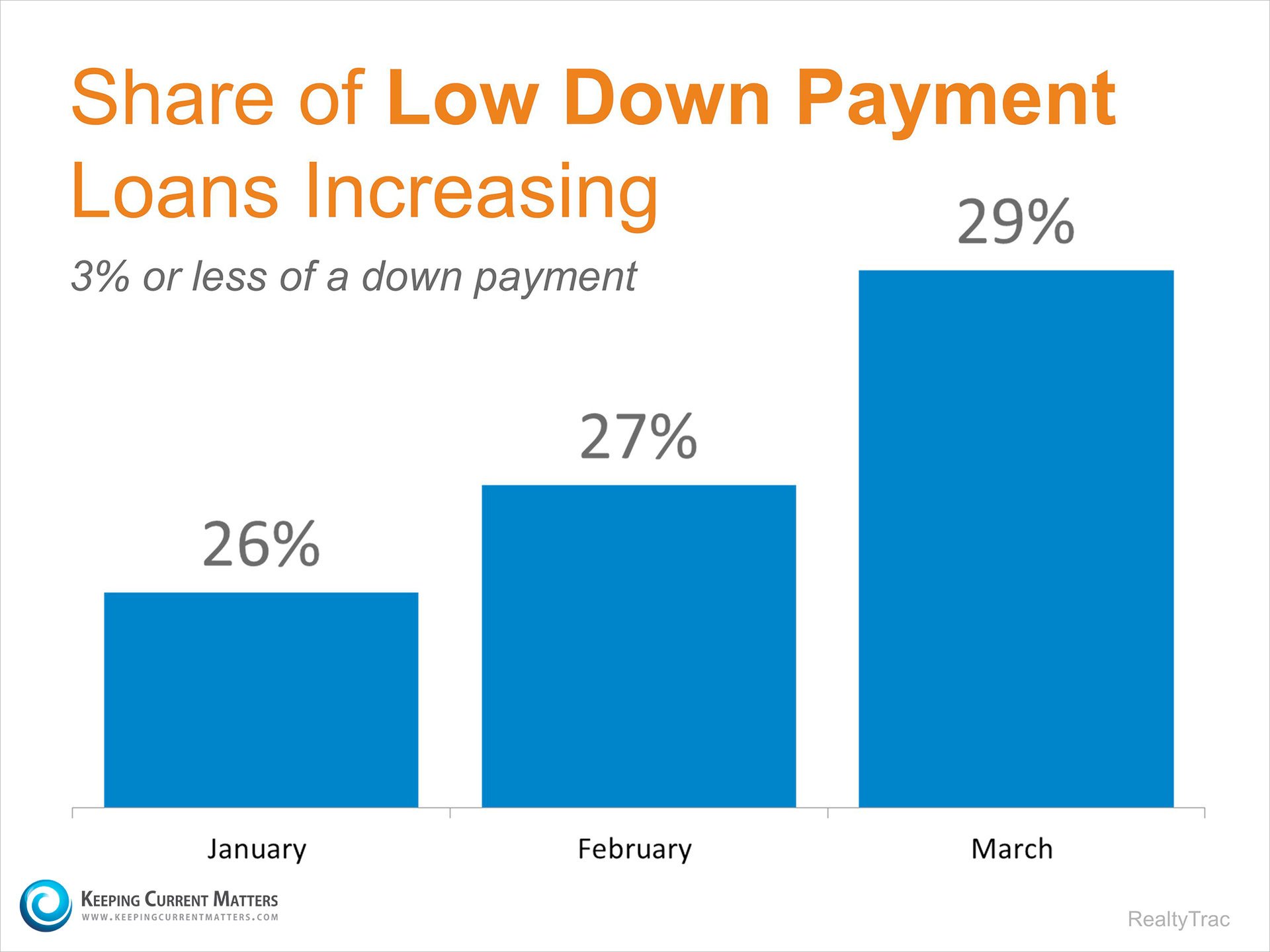

You DO NOT need 20% down to get a Home Loan

A recent survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 36% think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less and the number has increased through the first quarter of the year as shown by the graph below:

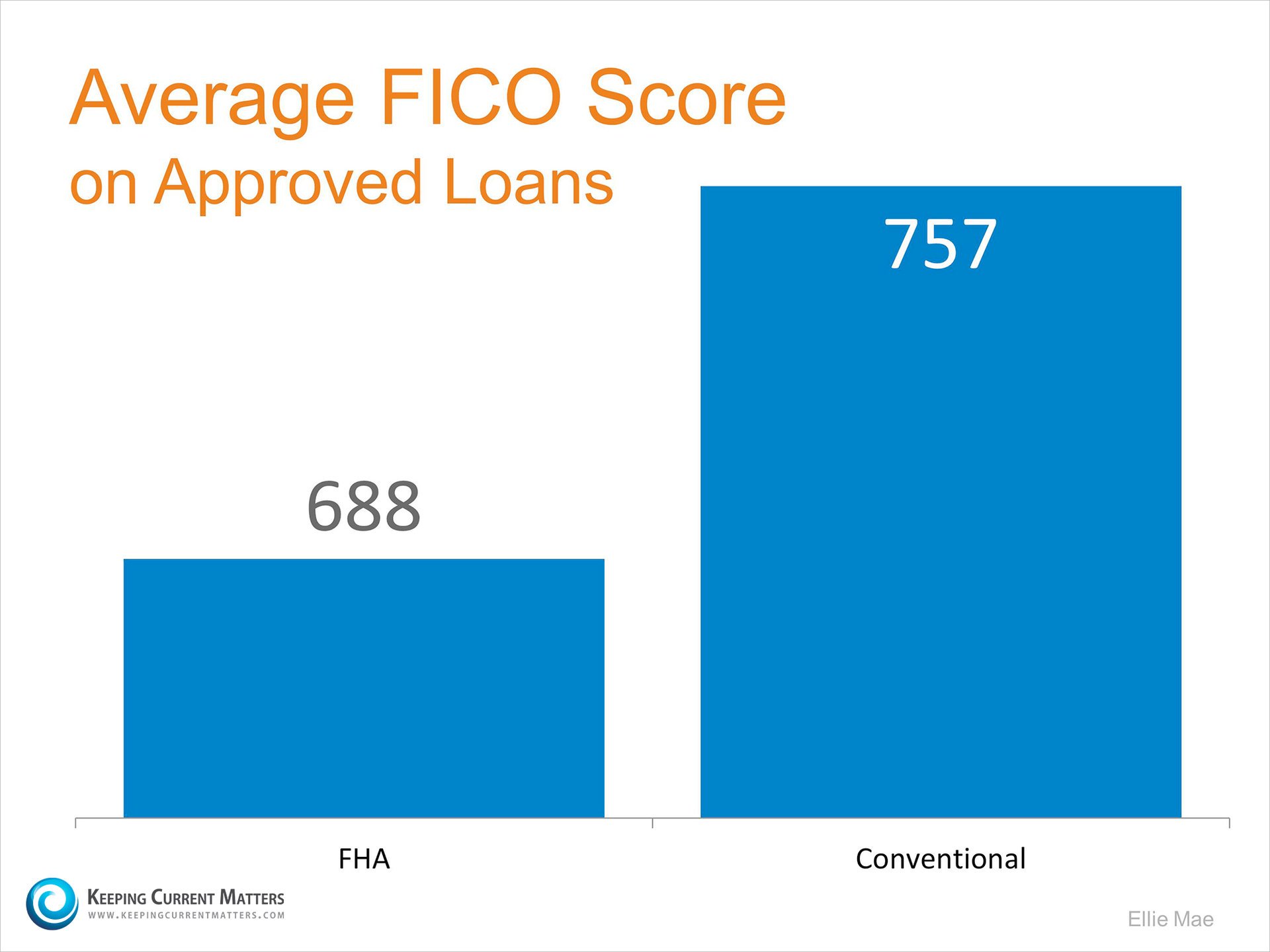

2. FICO Scores

The survey also reported that two-thirds of the respondents believe they need a very good credit score to buy a home, with 45 percent thinking a “good credit score” is over 780. In actuality, the average FICO scores of approved conventional and FHA mortgages are much lower:

Bottom Line

If you are a prospective purchaser who is ‘ready’ and ‘willing’ to buy but not sure if you are also ‘able’, sit down with someone who can help you understand your true options.

Friday, June 5, 2015

Mortgage Rates over the Last 40 Years

Highlights:

30-year mortgage rates are projected to increase by a full percentage point in 2016

Rates are still well below the past four decade averages

The interest rate at which you borrow the funds to purchase your dream home makes a huge difference on your monthly payment

Rates are still well below the past four decade averages

The interest rate at which you borrow the funds to purchase your dream home makes a huge difference on your monthly payment

Thursday, June 4, 2015

The #1 Reason to Buy Right Now - The Money!

People often ask whether they should buy a home now or wait. Recently released data suggests that waiting may not make sense as prices seem to again be on the rise. Let’s take a look at some of the data and commentary on the subject:

Ed Stansfield, chief property economist at Capital Economics:

“The current tightness of supply conditions would normally be consistent with much faster price growth. The continued steady growth in home sales that we expect this year will only add to this upward pressure on prices.”

Case Shiller Home Price Index

“The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual gain in March 2015 … with a 0.8% increase for the month.”

Anand Nallathambi, CEO of CoreLogic

“All signs are pointing toward continued price appreciation throughout 2015… Tight inventories, job growth and the impact of demographics and household formation are pushing price levels in many states toward record levels.”

Danielle Hale, Director of Housing Statistics at NAR

“Even without further acceleration, the pace of price growth remains too high. Strong buyer demand and low inventories coupled with relatively low new construction are helping to push prices up, keeping the housing market tipped in favor of sellers.”

FHFA Principal Economist Andrew Leventis

"The first quarter saw strong and widespread home price growth throughout most of the country. Home prices are now, on average, roughly 20 percent above where they were three years ago. This run-up has been historically exceptional and is particularly notable in light of the limited household income growth and modest rate of overall inflation observed during that same time period."

Bottom Line

If you are planning on buying a home in the near future, waiting probably doesn’t make sense from a purely pricing standpoint.

Monday, June 1, 2015

Today Kicks Off National Homeownership Month!

National Homeownership Month actually started as a week-long celebration of homeownership during the Clinton administration in 1995. In 2002, President George W. Bush proclaimed June as the National Homeownership Month. Here is an excerpt from his proclamation:

“Homeownership is an important part of the American Dream…A home provides shelter and a safe place where families can prosper and children can thrive. For many Americans, their home is an important financial investment, and it can be a source of great personal pride and an important part of community stability.”“Homeownership encourages personal responsibility and the values necessary for strong families. Where homeownership flourishes, neighborhoods are more stable, residents are more civic-minded, schools are better, and crime rates decline.”“During National Homeownership Month, I encourage all Americans to learn more about financial management and to explore homeownership opportunities in their communities. By taking this important step, individuals and families help safeguard their financial futures and contribute to the strength of our Nation.”

If you are one of the many renters out there who would like to make the transition from renter to homeowner, contact a local real estate professional who can help evaluate your ability to do so.

Thursday, May 28, 2015

Now is the Time to Sell Your Home - Demand is High

If you thought about selling your house this year, now is the time to do it. The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We were still in high school when we learned the concept of supply and demand: the best time to sell something is when supply of that item is low and demand for that item is high. That defines today’s real estate market.

Jonathan Smoke, the chief economist of realtor.com, in a recent article revealed:

“Our preliminary review of April activity on realtor.com shows that traffic, searches, and listing views are up more than 35% over last year. With 3 million jobs created and close to 1.5 million new households formed in the past 12 months, many more people want a new home of their own, and they want it bad. Their patience will be tested with tight supply—indeed, the No. 1 impediment of active shoppers in April was not being able to find a home that meets their needs.”

In this type of market, a seller may hold a major negotiating advantage when it comes to price and other aspects of the real estate transaction including the inspection, appraisal and financing contingencies.

Bottom Line

As a potential seller, you are in the driver’s seat right now. Its time to hit the gas.

Give me a call or email today for a free market analysis of your home.

Thursday, May 14, 2015

Housing Update: Demand Up, Supply Down, Prices Increasing

Earlier this week, the National Association of Realtors (NAR) released their latest quarterly report. The report covered three important aspects of the housing market:

- Buyer Demand

- Supply of Housing Inventory

- Single Family Residential Prices

Buyer Demand

Total existing-home sales (which include single family and condo) were at an annual rate of 4.97 million in the first quarter of 2015. This represents a number which is 6.2 percent higher than the pace during the first quarter of 2014.

Yun: "Sales activity to start the year was notably higher than a year ago, as steady hiring and low interest rates encouraged more buyers to enter the market."

Supply of Housing Inventory

There were 2 million existing homes available for sale at the end of the first quarter of 2015 which represents a 4.6 months’ supply of inventory which down from 4.9 months a year ago. A healthy balance of supply between buyers and sellers is 6 to 7 months.Yun: "With supply remaining tight—especially at the entry-level price range—buyers will need the expertise and local market insight of a Realtor® to help them through each intricate step of the buying process."

Single Family Residential Prices

Home prices accelerated in 148 out of 174 metro areas (85%) during the first quarter of 2015. and the number of areas experiencing double-digit price appreciation doubled compared to last quarter. Compared to last quarter, the number of regions experiencing double-digit price appreciation doubled. The national median existing single-family home price in the first quarter was $205,200, compared to $191,100 in first quarter of 2014. This represents a 7.4% increase year-over-year.Yun: “…stronger demand without increasing supply led to faster price growth in many markets…Homeowners throughout the country have enjoyed accumulating household wealth through the steady rise in home values in the past few years."

Bottom Line

Whether you are thinking about buying your first home or selling your current residence to buy the home of your dreams, call me today to discuss how the numbers above have affected your neighborhood's prices.Tuesday, May 5, 2015

Monday, May 4, 2015

4 Reasons to Move Up this Spring

Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider buying today instead of waiting.

1.) Buyer Demand is High & Inventory Is Low

Recent numbers show that buyer demand is at the highest peak experienced in years, and inventory for sale is at a 4.6 months supply, which is still markedly lower than the 6.0 months needed for a historically normal market. The National Association of Realtors, Chief Economist, Lawrence Yun put it this way, "Demand in many markets is far exceeding supply, and properties in March sold at a faster rate than any month since last summer."

Listing your home today can greatly increase exposure to buyers who are out in force and ready to act.

2.) Prices Will Continue to Rise

The Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects appreciation in home values over the next five years to be between 11.7% (most pessimistic) and 27.5% (most optimistic). The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting for your current home’s value to increase before selling could price you out of your new home if you aren’t careful.

3.) Mortgage Interest Rates Are Still Near Record Lows

As we reported last week, interest rates have remained below 4% for some time now, and are substantially lower than the rate previous generations paid when getting a mortgage. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison projecting that rates will rise over the next 12 months. An increase in rates will impact YOUR monthly mortgage payment. Even an increase of half a percentage point can put a dent in your family’s net worth. Whether you are moving up or buying your first home, your housing expense will be more a year from now if a mortgage is necessary to purchase your home.

4.) It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise. But, what if they weren’t? Would you wait? Look at the actual reason you are buying and decide whether it is worth waiting. Have you always wanted to live in a certain neighborhood? Would a climate change be just what the doctor ordered? Would you like to be closer to family?

Bottom Line

If the right thing for you and your family is to move up to your dream home this year, buying sooner rather than later could lead to substantial savings.

Friday, May 1, 2015

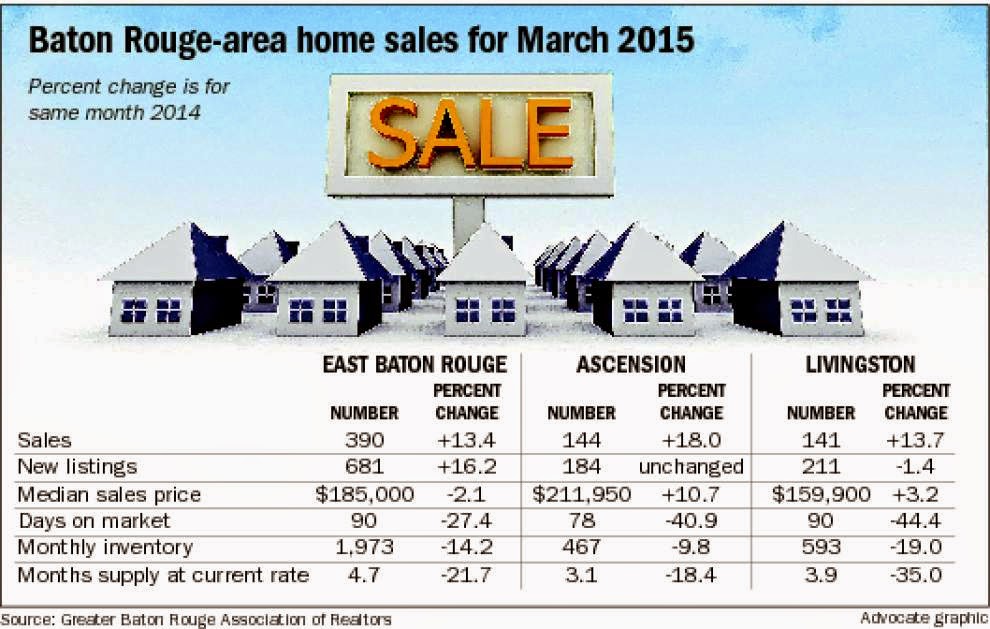

Baton Rouge area home sales up nearly 15 percent in March

The number of houses sold in metro Baton Rouge jumped 14.7 percent in March when compared with figures from the year before.

There were 755 homes sold in March in the nine-parish area, according to figures released Thursday by the Greater Baton Rouge Association of Realtors’ Multiple Listing Service. That compares with 658 MLS sales in March 2014.

Ascension Parish led the sales gain, with 144 homes being sold in the parish in March, an 18 percent increase over the 122 sales a year before. A limited inventory of available homes for sale had stymied sales in the parish for the past few months.

Livingston Parish had a 13.7 percent gain in sales during March, going from 124 sales in 2014 to 141 MLS transactions.

And East Baton Rouge Parish, which accounts for the largest percentage of sales in the metro area, had a 13.4 percent gain. There were 390 MLS sales in the parish during March, compared with 344 in 2014.

The median home sales price rose by 3.8 percent in March, to $184,900 from $178,110 — meaning half the houses sold for more and half for less than that price. The number of homes for sale fell 13.8 percent to 3,588. The supply in months was 4.5, compared with 5.9 in 2014. Six months is considered an ample supply. The average amount of time a home stayed on the market until being sold was 92 days, down from 94 in 2014. The number of new listings was up 5.5 percent from 1,136 in March 2014 to 1,198. And in a sign of future activity, the number of pending sales rose by 17.7 percent from 838 to 986. Through the first three months of the year, there were 1,923 home sales in the metro area, compared with 1,788 through March 2014, a 7.6 percent increase.

Sales were up 15.1 percent in Livingston for the first quarter of the year, going from 311 to 358.

East Baton Rouge saw a 10.1 percent increase through the same period, coming in at 1,017 closed sales compared with 924 in 2014.

Ascension sales were up 1.9 percent from 363 through the first quarter of 2014 to 370 this year.

The median home sales price rose by 3.8 percent in March, to $184,900 from $178,110 — meaning half the houses sold for more and half for less than that price. The number of homes for sale fell 13.8 percent to 3,588. The supply in months was 4.5, compared with 5.9 in 2014. Six months is considered an ample supply. The average amount of time a home stayed on the market until being sold was 92 days, down from 94 in 2014. The number of new listings was up 5.5 percent from 1,136 in March 2014 to 1,198. And in a sign of future activity, the number of pending sales rose by 17.7 percent from 838 to 986. Through the first three months of the year, there were 1,923 home sales in the metro area, compared with 1,788 through March 2014, a 7.6 percent increase.

Sales were up 15.1 percent in Livingston for the first quarter of the year, going from 311 to 358.

East Baton Rouge saw a 10.1 percent increase through the same period, coming in at 1,017 closed sales compared with 924 in 2014.

Ascension sales were up 1.9 percent from 363 through the first quarter of 2014 to 370 this year.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate