Friday, May 30, 2014

Wednesday, May 28, 2014

Create Wealth: Move Up Now

Many experts are currently discussing a variety of topics such as

real estate as an investment, the movement on mortgage interest rates

and reasons to buy now instead of waiting. It is important that we

realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

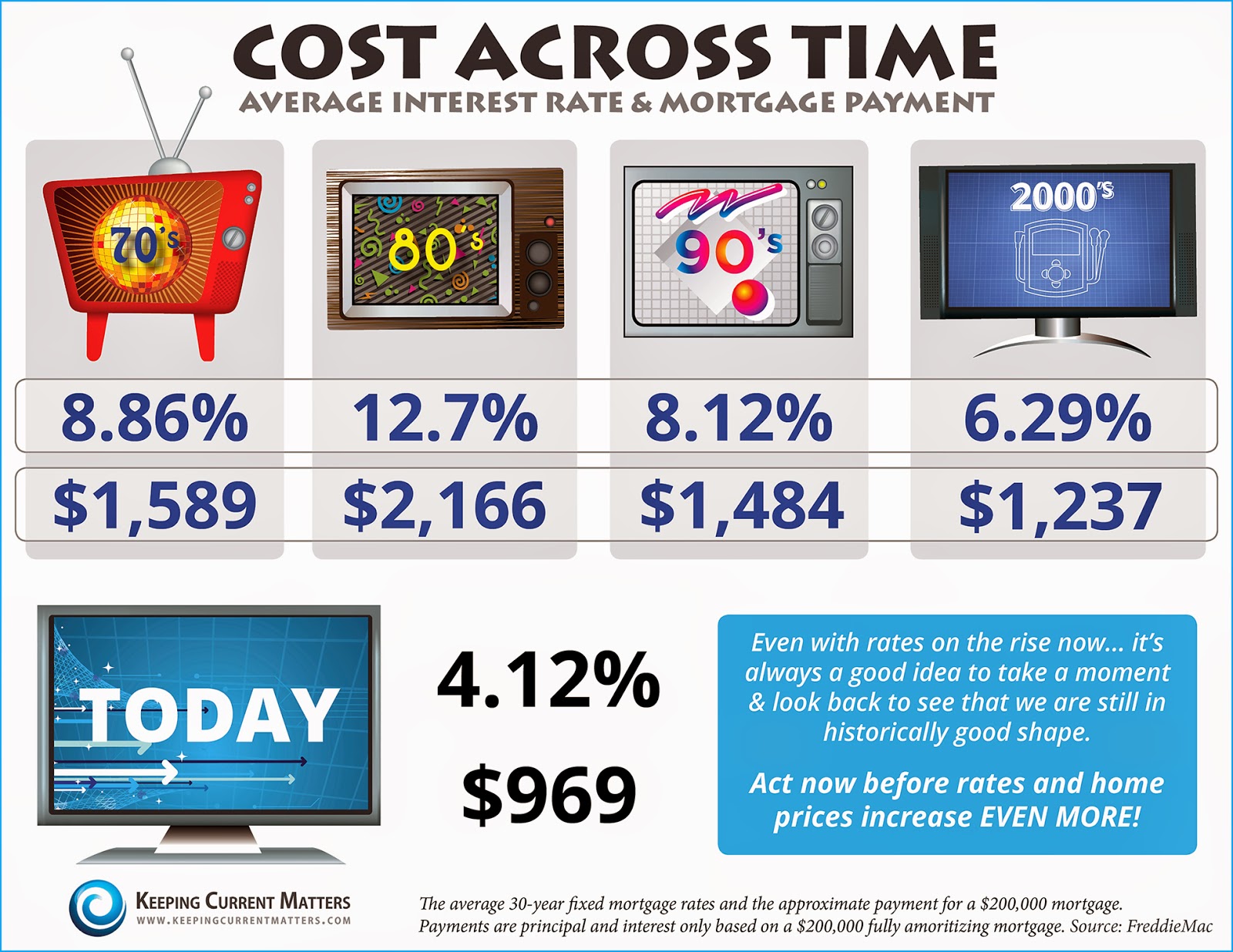

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

Tuesday, May 27, 2014

4 Propery Flaws that will Block Offers on Your Home

The most common things buyers hate about listings they see.

#1: Odors.

#2: Glaringly extreme overpricing.

#3: Dirt and messes.

#4: Lots of little malfunctions.

Monday, May 26, 2014

5 Financial Reasons to Buy a Home

Eric Belsky is Managing Director of the Joint Center

of Housing Studies at Harvard University. He also currently serves on

the editorial board of the Journal of Housing Research and Housing

Policy Debate. Last year he released a paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Bottom Line

We realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.Wednesday, May 21, 2014

Future House Prices

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics

surveys a nationwide panel of over one hundred economists, real estate

experts and investment & market strategists about where prices are

headed over the next five years. They then average the projections of

all 100+ experts into a single number.

The results of their latest survey

The results of their latest survey

- Home values will appreciate by 4.4% in 2014.

- The cumulative appreciation will be 19.5% by 2018.

- That means the average annual appreciation will be 3.6% over the next 5 years.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of 9.4% by 2018.

Wednesday, May 14, 2014

5 Reasons You NEED a Real Estate Professional

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to rising interest rates & home prices as the market recovers.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth?

Not only is it important for your home to be priced correctly from the start, to attract the right buyers and shorten the time that it’s on the market, but you also need someone who is not emotionally connected to your home, to give you the truth as to your home’s value.

According to the National Association of REALTORS, “the typical FSBO home sold for $184,000 compared to $230,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market?

There is so much information out there on the news and the Internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to, to tell you how to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer?

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” – Dave Ramsey

Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line:

You wouldn’t hike up Kilimanjaro without a Sherpa, or replace the engine in your car without a trusted mechanic, why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional?

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to rising interest rates & home prices as the market recovers.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth?

Not only is it important for your home to be priced correctly from the start, to attract the right buyers and shorten the time that it’s on the market, but you also need someone who is not emotionally connected to your home, to give you the truth as to your home’s value.

According to the National Association of REALTORS, “the typical FSBO home sold for $184,000 compared to $230,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market?

There is so much information out there on the news and the Internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to, to tell you how to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer?

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” – Dave Ramsey

Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line:

You wouldn’t hike up Kilimanjaro without a Sherpa, or replace the engine in your car without a trusted mechanic, why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional?

Friday, May 2, 2014

Thursday, May 1, 2014

For a Home Upgrade, Should You Move or Improve?

Is it smarter to move or improve? Here’s some advice to help you decide.

Selling Has Gotten Easier

Existing-home sales were at their highest levels since 2006, and the median home price hit $197,100 at the end of 2013.

Right now, it’s taking just over two months, on average, for homes to sell. If you’ve been holding back on selling, waiting for the real estate market to recover, you may find it’s recovered in your area.

As you prepare your home for sale, consider what homebuyers want right now. Hint: energy efficiency. Demonstrating that your home is weather-sealed is a great selling point. Also, if you’re only up for a minimum amount of work, focus on curb appeal, your kitchen (even tweaks can make a big difference), and pricing your home right. The offers will come.

More Tips

During the economic slump, home improvement spending slowed, so contractors were willing to cut deals to stay busy. Today, they’re less willing to bargain on price and too busy to accept low-profit jobs. In addition, the cost of construction materials may be going up. In a recent National Association of Home Builders survey:

Figure paying somewhere between $100 and $200 a square foot for new construction or a major remodel, depending on the scope of the project and labor costs in your area. For instance, a two-story addition with a family room, bedroom, and bathroom costs a national average of $155,365, according to “Remodeling” magazine’s “2014 Cost vs. Value Report.”

Now more than ever you need to make sure that you invest your money wisely. In other words, will your $75,000 kitchen remodel increase your home value by $75,000—or by anything close? Not likely. But at resale you may be able to recoup some of your remodeling costs. For guidelines, check out the Cost vs. Value Report, which gives the national average annual cost and payback figures for 35 popular remodeling projects.

To assess what’s right for your particular house, let your neighborhood be your guide. If there’s any chance you’ll move within the next 10 years, keep your improvements in line with those of other houses on your block, or risk losing the money when you sell. Of course, don’t discount your enjoyment factor. If it’ll make you happy to install an in-ground pool in a neighborhood without pools, go for it.

Critical Considerations

Your house isn’t just your largest investment, of course, it’s also the place where your family lives. Financial considerations aside, the question of whether to move or improve should be decided by the things you can’t change about your current home:

Selling Has Gotten Easier

Existing-home sales were at their highest levels since 2006, and the median home price hit $197,100 at the end of 2013.

Right now, it’s taking just over two months, on average, for homes to sell. If you’ve been holding back on selling, waiting for the real estate market to recover, you may find it’s recovered in your area.

As you prepare your home for sale, consider what homebuyers want right now. Hint: energy efficiency. Demonstrating that your home is weather-sealed is a great selling point. Also, if you’re only up for a minimum amount of work, focus on curb appeal, your kitchen (even tweaks can make a big difference), and pricing your home right. The offers will come.

More Tips

- Take a look at homes for sale in your market to get an idea of what you can get for your money today.

- Check your credit report to make sure it’s accurate and up-to-date.

- Fix mistakes you find in your credit report.

- Get prequalified for a mortgage so you know how much you can spend.

- Ask your REALTOR® to send you current listings from your target neighborhood.

During the economic slump, home improvement spending slowed, so contractors were willing to cut deals to stay busy. Today, they’re less willing to bargain on price and too busy to accept low-profit jobs. In addition, the cost of construction materials may be going up. In a recent National Association of Home Builders survey:

- 81% of contractors were concerned about rising materials prices

- 65% were concerned about rising labor costs

Figure paying somewhere between $100 and $200 a square foot for new construction or a major remodel, depending on the scope of the project and labor costs in your area. For instance, a two-story addition with a family room, bedroom, and bathroom costs a national average of $155,365, according to “Remodeling” magazine’s “2014 Cost vs. Value Report.”

Now more than ever you need to make sure that you invest your money wisely. In other words, will your $75,000 kitchen remodel increase your home value by $75,000—or by anything close? Not likely. But at resale you may be able to recoup some of your remodeling costs. For guidelines, check out the Cost vs. Value Report, which gives the national average annual cost and payback figures for 35 popular remodeling projects.

To assess what’s right for your particular house, let your neighborhood be your guide. If there’s any chance you’ll move within the next 10 years, keep your improvements in line with those of other houses on your block, or risk losing the money when you sell. Of course, don’t discount your enjoyment factor. If it’ll make you happy to install an in-ground pool in a neighborhood without pools, go for it.

Critical Considerations

Your house isn’t just your largest investment, of course, it’s also the place where your family lives. Financial considerations aside, the question of whether to move or improve should be decided by the things you can’t change about your current home:

- School district

- The amount of traffic on your street

- Size and layout of your yard

- Commute time

- Access to markets and malls

- Neighborhood quality of life

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate