http://www.businessreport.com/article/capital-region-homes-sales-end-2014-3-2

Though East Baton Rouge Parish sales were flat, total home sales in the eight-parish Capital Region for 2014 finished 3.2% higher than in 2013, aided by a strong December in which area sales jumped by 6.4% compared to the same month the previous year. In its latest monthly report, released today, the Greater Baton Rouge Association of Realtors says 8,903 homes were sold last year in East Baton Rouge, Ascension, Livingston, West Baton Rouge, East Feliciana, West Feliciana, Iberville and Pointe Coupee parishes.

The association recorded 8,625 sales in those parishes in 2013. The average home sale price in the Capital Region rose 2.3% last year to $203,203.

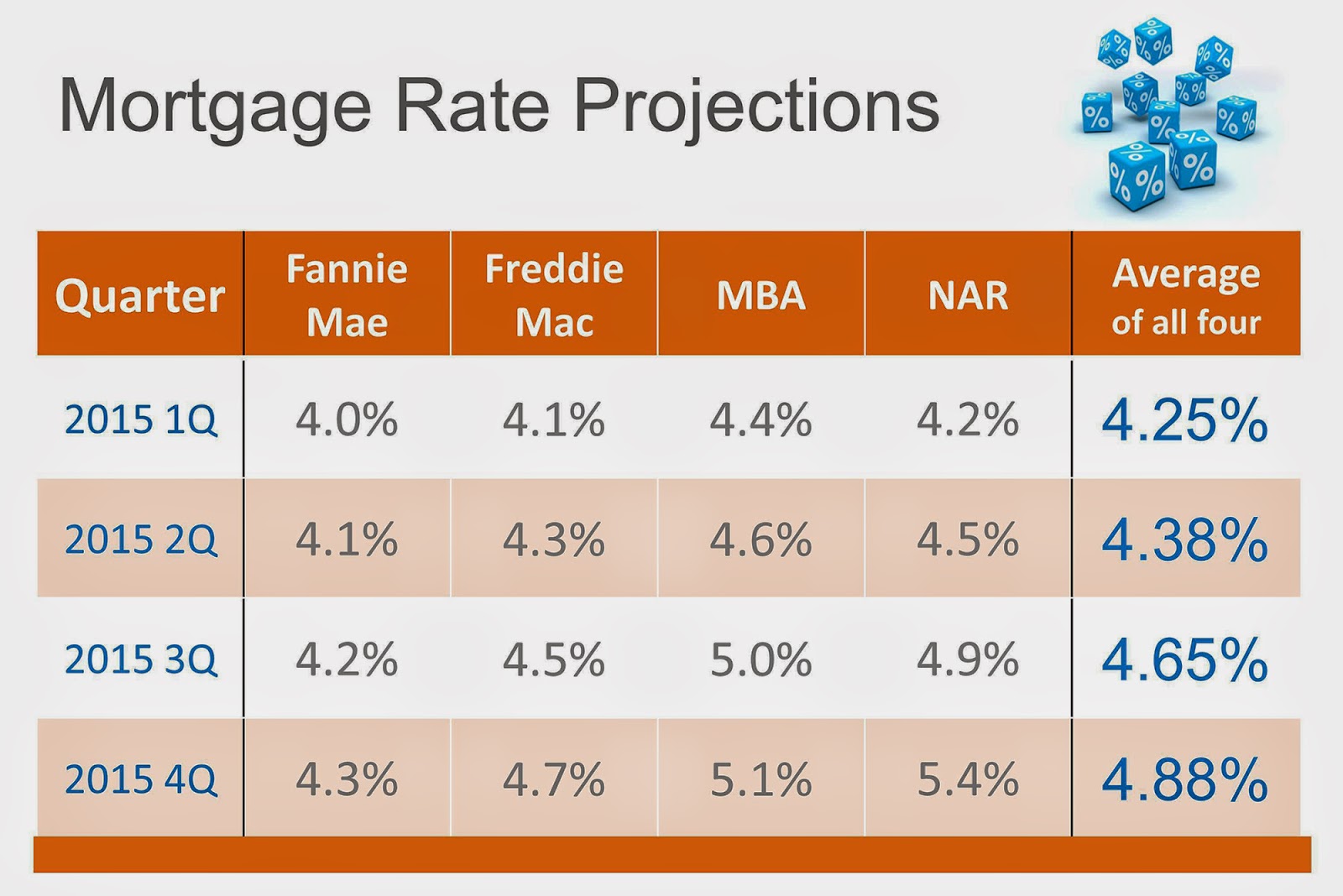

“There’s no reason to think that 2015 isn’t going to be another really strong year,” says GBRAR President Donna Wolff. “Our economy is really strong, our job market is extremely healthy and if interest rates stay low like they have been—and the predictions are that they may not really climb until the end of the year—I don’t see why 2015 won’t be even better than this year.”

While the Capital Region posted a year-over-year increase in sales in 2014, East Baton Rouge Parish hardly changed. The parish registered 4,700 total sales, just eight fewer than the 2013 tally and a 0.2% decline. Ascension Parish, meanwhile, notched 1,720 sales last year, an increase of 3.2% over the 2013 total. Livingston Parish saw annual sales rise by 10.8% last year to 1,639. Inventory is particularly low in Ascension in Livingston, Wolff notes. There were 451 homes for sale in Ascension during December, 13.4% less than were available in December 2013. In Livingston, 587 homes were on the market in December, 21.4% fewer than the previous year.

The months supply of inventory figure—or the number of months it would take to sell the entire inventory at the current sales rate—was at three months in Ascension and 4.1 months in Livingston at the close of 2014. Realtors consider any reading below six months to reflect a seller’s market. In East Baton Rouge Parish, the months supply of inventory was at five months at the end of last year, also indicating a seller’s market and a decline of 1.1 months from December 2013.

—Steve Sanoski