The Gallup organization just released their April Economy and Personal Finances Poll

which asked Americans to choose the best option for long term

investment. It was no surprise to us that real estate returned to the

top position over other investment categories (gold, stocks/mutual

funds, savings accounts/CDs and bonds).

Back in 2011, gold was the most popular long-term investment among

Americans. However, with the housing market improving across the U.S.

and home prices rising, more Americans now consider real estate the best

option for long-term investments.

Visit www.brandyfarris.com for thousands of homes in your area!

Monday, April 28, 2014

Tuesday, April 22, 2014

True Cost of Waiting to Buy a Home

Let’s say your 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

Or you could look at it this way:

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,764, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $112,932, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $112,932, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

The difference in payment is $313.70 PER MONTH!

That’s like taking a $10 bill and tossing it out the window EVERY DAY!Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (Average $2) with $12 left for lunch!

- There goes Friday Sushi Night! ($80 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $22,000 car for $313.00 per month.

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $3,764, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $112,932, all because when you were 30 you thought moving in 2014 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready, but if they showed you that you could save $112,932, you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

Monday, April 21, 2014

Either Way, You're Still Paying a Mortgage

There are some people that have not purchased a home because they are

uncomfortable taking on the obligation of a mortgage. Everyone should

realize that, unless you are living with our parents rent free, you are

paying a mortgage - either your mortgage or your landlord’s.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period.

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices.

Thursday, April 17, 2014

Real Estate: This Spring Will Be Different

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

MILLENNIALS

Contrary to many reports, this age demographic is READY, WILLING and ABLE to become homeowners. As a matter of fact, the latest National Association of Realtors’ gender study revealed that the Millennial generation has recently accounted for a greater percentage of all buyers than any other generation.

BABY BOOMERS

As prices have risen, so has the equity in many homes across American. Homeowners, having been shackled to their house because of low or negative equity for the last several years, are again free to make a move without worrying about bringing cash to a closing table in order to sell. We believe this new-found freedom will release a pent-up demand of sellers who want to move-up to the home they’ve always dreamed of or want to downsize their primary residence and also purchase a second home they can use for vacation, retirement or both.BOTH PRICES and MORTGAGE RATES are on the RISE

As the economy improves, more and more Americans are regaining faith that their ownpersonal finances are headed in a positive direction. With this new confidence, they want to take advantage of the opportunity that presents itself with real estate still undervalued in most parts of the country and mortgage rates being well below historic numbers.

Wednesday, April 16, 2014

Current Mortgage Rates Won't Last Forever..

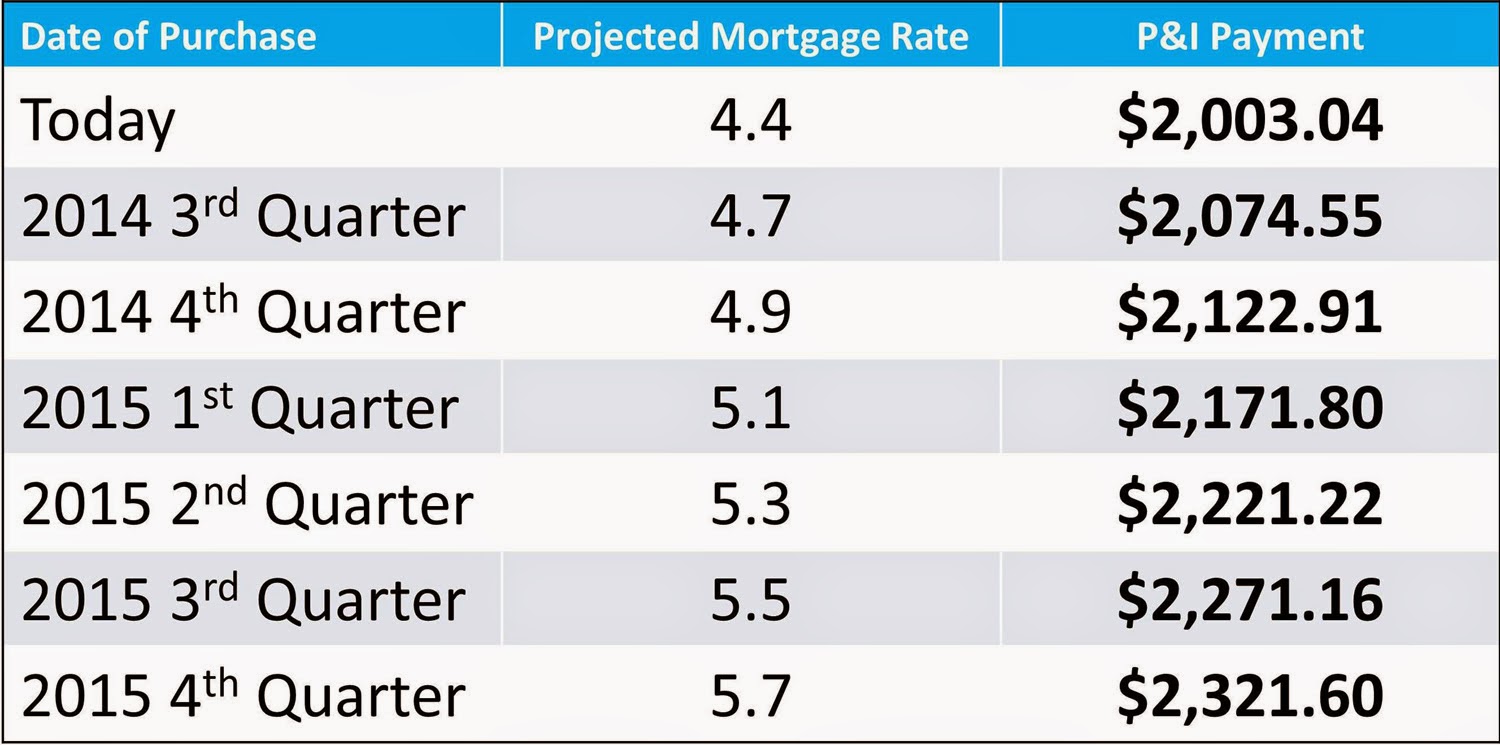

According to FreddieMac, the interest rate for a 30 year fixed rate mortgage at the beginning of April was 4.4%. However, FreddieMac predicts that mortgage rates will steadily climb over the next six quarters.

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house?

Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels.

This table shows how a principal and interest payment is impacted by a rise in interest rates:

Monday, April 14, 2014

Want to Sell Your House? Price it Right!

The housing market is recovering nicely. Prices have increased

nationally by double digits over the last twelve months. Competition

from the shadow inventory of lower priced distressed properties

(foreclosures and short sales) is diminishing rapidly. Now may be the

perfect time to sell your home and move to the dream house or beautiful

location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase.

Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter.

Bottom Line

Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.

Friday, April 11, 2014

Baton Rouge Residential Real Estate Market "ON FIRE"

Big gains in sales of homes priced at $300,000

and above over the past year have the Greater Baton Rouge residential

market "on fire" right now, says Tom Cook, who was among the presenters

at today's TRENDS in Real Estate Seminar.

Sales of homes priced above $400,000

saw a particularly significant increase of 55% between March of last

year and February, Cook said, while new home sales between $300,000 and

$400,000 also rose by 37% over the same time frame.

"Still, the bulk of the market is in the

smaller home market," said Cook, of Cook, Moore & Associates, who

estimates sales of homes below $300,000 account for approximately 77% of

total sales in the market.

Sales of homes priced between $225,00

and $300,000 were up 33% between March of last year and February, while

those priced between $100,000 and $225,000 were up just shy of 9%.

Taking a broader look at residential

trends, Cook noted the eight-parish Capital Region market represented by

the Greater Baton Rouge Association of Realtors saw a 15% increase in

total number of sales in 2013—which built upon a 14% increase during the

year previous. Total sales volume increased 19% last year, while the

average sales price rose 3.36% in 2013 and the average number of days a

home sat on the market before selling dropped from 123 to 86.

Still, Ty Gose of NAI/Latter & Blum assured the nearly 700 attendees of today's half-day seminar that the market will be able to absorb the additional apartments and condos. "Based on what the national experts are saying, we're not overbuilding," he says.

Homeownership's Impact on Net Worth

Over the last six years, homeownership has lost some of its allure as

a financial investment. As homeowners suffered through the housing

bust, more and more began to question whether owning a home was truly a

good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

Thursday, April 10, 2014

Eisenberg: Economic indicators positive - Baton Rouge, LA

While economist Elliot Eisenberg—keynote speaker

for today's TRENDS in Real Estate Seminar—enthusiastically called the

state of the Louisiana and Baton Rouge economies a "happy story," he

warned that the energy boom won't last forever. "You know it will end,"

Eisenberg told those gathered this morning at the BREC Independence Park

Theatre for the half-day seminar. "Energy booms always end. I would try

and plan for what happens the day after. Lafayette in '86 wasn't a

happy place, remember that. Nothing good lasts forever. Don't say this

time will be different, because it won't be different." Still, Eisenberg

detailed a mostly optimistic outlook for the state and Capital Region,

celebrating the the area's low unemployment rate, labor force

growth—which is above the national average—and 5% increase in home

prices since last year. "You're a happy city and a happy state, you

really are," said Eisenberg, a nationally acclaimed economist and

speaker based in Washington, D.C. By contrast, he noted, the national

economy is improving, but at a slower pace than has been seen locally.

Crediting less economic uncertainty and increased capital expenditures,

Eisenberg said we are now entering the "pleasant phase of the recovery."

"Overall, the economy really is improving," he said, adding that he

expects "interest rates will go up because of it." The 26h Annual TRENDS

in Real Estate Seminar, hosted by the Greater Baton Rouge Association

of Realtors Commercial Investment Division, kicked off this morning with

Eisenberg's keynote address and will continue through noon. With

roughly 680 registered to attend, this will be the largest TRENDS

seminar since 2006, according to GBRAR Communications Director Saiward

Pharr Hromadka. Read Daily Report PM later today for more coverage from the seminar. —Rachel Alexander

Wednesday, April 9, 2014

BR said to be best-performing post-recession housing market in nation

The Baton Rouge metro area housing market is performing about 42% better than it was during pre-recession "normal levels," making it the best performing market among the 350 in the nation included in the latest National Association of Home Builders/First American Leading Markets Index report, released Monday. In calculating each metro area's index score, the NAHB uses data from the Bureau of Labor Statistics, house price appreciation data from Freddie Mac and single-family housing permits from the U.S. Census Bureau. As for the pre-recession, "normal levels" of activity used to compare current data to, NAHB says it uses permit and price data from 2000-2003, as well as employment data from 2007. Baton Rouge is ranked as the top-performing large metro area in the country in the latest index report, topping others cities in the top 10 such as Honolulu, Oklahoma City, Austin, Houston, Los Angeles and New Orleans—which is ranked No. 9. Nationwide, the U.S. average index score indicates that based on current permit, price and employment data, the nation is running at only about 88% of normal economic and housing activity. NAHB has more details. As previously reported, year-to-date home sales through February in the eight-parish Capital Region are up 10.1% over 2013 figures. Meanwhile, at $187,241, the average sale price is up 0.7% over last year's average through February. —Staff report

Tuesday, April 8, 2014

3 REASONS TO SELL YOUR HOME THIS SPRING

3 REASONS TO SELL YOUR HOME THIS SPRING

Many sellers are still hesitant about

putting their house up for sale. Where are prices headed? Where are

interest rates headed? These are all valid questions. However, there

are several reasons to sell your home sooner rather than later. Here

are three of those reasons.

1. DEMAND IS ABOUT TO SKYROCKET

Most people realize that the housing market is hottest from April through June. The most serious buyers are well aware of this and, for that reason, come out in early spring in order to beat the heavy competition. We also have a pent-up demand as many buyers pushed off their home search this winter because of extreme weather. These buyers are ready, willing and able to buy…and are in the market right now!

2. THERE IS LESS COMPETITION - FOR NOW

Housing supply always grows from the spring through the early summer. Also, there has been a growing desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners have seen a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future.

1. DEMAND IS ABOUT TO SKYROCKET

Most people realize that the housing market is hottest from April through June. The most serious buyers are well aware of this and, for that reason, come out in early spring in order to beat the heavy competition. We also have a pent-up demand as many buyers pushed off their home search this winter because of extreme weather. These buyers are ready, willing and able to buy…and are in the market right now!

2. THERE IS LESS COMPETITION - FOR NOW

Housing supply always grows from the spring through the early summer. Also, there has been a growing desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners have seen a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future.

The choices buyers have will continue

to increase over the next few months. Don’t wait until all the

other potential sellers in your market put their homes up for

sale.

3. THERE WILL NEVER BE A BETTER TIME TO MOVE-UP

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by approximately 4% this year and 8% by the end of 2015. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate at about 4.5% right now. Freddie Mac projects rates to be 5.1% by this time next year and 5.7% by the fourth quarter of 2015.

Moving up to a new home will be less expensive this spring than later this year or next year.

3. THERE WILL NEVER BE A BETTER TIME TO MOVE-UP

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by approximately 4% this year and 8% by the end of 2015. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate at about 4.5% right now. Freddie Mac projects rates to be 5.1% by this time next year and 5.7% by the fourth quarter of 2015.

Moving up to a new home will be less expensive this spring than later this year or next year.

225-315-9003

Christiefarris@gmail.com

Monday, April 7, 2014

A Home's Cost VS. Price

Let's talk about the difference between COST and PRICE. As a

home seller, you will be most concerned about ‘short term price’ – where

home values are headed over the next six months. As either a first time

or repeat buyer, you must not be concerned about price but instead about

the ‘long term cost’ of the home. Let us explain.

Recently, it was reported that a nationwide panel of over one hundred economists, real estate experts and investment & market strategists projected that home values would appreciate by approximately 8% from now to the end of 2015.

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30 year fixed mortgage rate will be 5.7% by the end of next year!

Recently, it was reported that a nationwide panel of over one hundred economists, real estate experts and investment & market strategists projected that home values would appreciate by approximately 8% from now to the end of 2015.

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30 year fixed mortgage rate will be 5.7% by the end of next year!

What Does This Mean to a Buyer?

Here is a simple demonstration of what impact these projected changes would have on the mortgage payment of a home selling for approximately $250,000 today:Friday, April 4, 2014

Wednesday, April 2, 2014

New homes in Baton Rouge means the economy is improving

BATON ROUGE, LA (WAFB) -

Homeowners are seeing their homes sell quickly in Baton Rouge. Realtors say there are only a certain amount of homes on the market, now developers are cashing in by building new options.

One of those new neighborhoods, Magnolia Lakes, off Burbank Drive is where workers are hammering, sawing and framing homes.

"You're probably looking close to $225,000 to $250,000 for a newer house," even at that amount, you may only be looking at a little square footage. Buyers are likely to find more space in older, updated homes. But there are some who prefer new builds. In general, homes are on the market for about five months. That means what's available is dwindling.

"So somewhere we've got to get more inventory. That's where new construction comes in. That's where you're seeing so much new construction." With a stronger economy, there are now more people working and they are in a position to buy. That has developers looking for land to clear, to build on. For example, there are 80 acres off the Millerville exit where trees have been cleared for apartments and office space.

The Baton Rouge Area Chamber has predicted more jobs for the parish this year. That job growth, is what real estate agents say builders are banking on, to move their product. As far as how the new stock will affect market pricing, Wattam says Baton Rouge is experiencing what's called a level market. "Buyers are going to get a good value. Sellers are going to get what they want for their house. Those days of coming in $60,000 under, those days are gone." Agents say they are hearing interest rates are going up later this year.

Homeowners are seeing their homes sell quickly in Baton Rouge. Realtors say there are only a certain amount of homes on the market, now developers are cashing in by building new options.

One of those new neighborhoods, Magnolia Lakes, off Burbank Drive is where workers are hammering, sawing and framing homes.

"You're probably looking close to $225,000 to $250,000 for a newer house," even at that amount, you may only be looking at a little square footage. Buyers are likely to find more space in older, updated homes. But there are some who prefer new builds. In general, homes are on the market for about five months. That means what's available is dwindling.

"So somewhere we've got to get more inventory. That's where new construction comes in. That's where you're seeing so much new construction." With a stronger economy, there are now more people working and they are in a position to buy. That has developers looking for land to clear, to build on. For example, there are 80 acres off the Millerville exit where trees have been cleared for apartments and office space.

The Baton Rouge Area Chamber has predicted more jobs for the parish this year. That job growth, is what real estate agents say builders are banking on, to move their product. As far as how the new stock will affect market pricing, Wattam says Baton Rouge is experiencing what's called a level market. "Buyers are going to get a good value. Sellers are going to get what they want for their house. Those days of coming in $60,000 under, those days are gone." Agents say they are hearing interest rates are going up later this year.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate