- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house.

- The termite company if there are challenges

- The buyer’s lender if the structure of the mortgage requires the sellers’ participation

- The appraiser if there is a question of value

- The title company if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality if you need to get the COs permits mentioned above

- The buyer’s buyer in case there are challenges on the house your buyer is selling

- Your bank in the case of a short sale

Wednesday, December 30, 2015

Selling on your own? Get ready to negotiate!

Now that the market has shown signs of recovery, some sellers may be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. Real estate agents are trained and experienced in negotiation. In most cases, the seller is not. The seller must realize their ability to negotiate will determine whether they can get the best deal for themselves and their family. Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

Tuesday, December 22, 2015

Building Family Wealth Over the Next 5 Years - Real Estate

As the economy continues to improve, more and more Americans are seeing their personal financial situations also improving. Instead of just getting by, many are now beginning to save and find other ways to build their net worth. One way to dramatically increase their family wealth is through the acquisition of real estate.

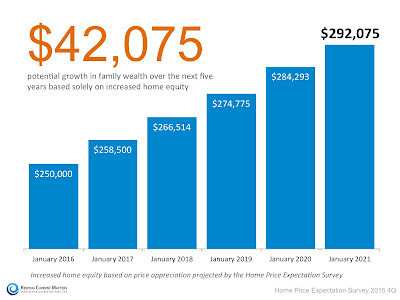

For example, let’s assume a young couple purchases and closes on a $250,000 home in January. What will that home be worth five years down the road?

Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists every quarter. They ask them to project how residential prices will appreciate over the next five years. According to their latest survey, here is how much value that $250,000 house will gain in the coming years.

Over a five year period, that homeowner can build their home equity to over $40,000. And, in many cases, home equity is large portion of a family’s overall net worth.

Bottom Line

If you are looking to better your family’s long-term financial situation, buying your dream home might be a great option.

Friday, December 4, 2015

The Difference your Interest Rate Makes

Some Highlights:

- Interest rates have come a long way in the last 30 years.

- The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford.

- Experts predict that rates will increase by 3/4 a percent over the next 12 months.

- Secure a low rate now to get the most house for your money.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate