Friday, January 31, 2014

Wednesday, January 29, 2014

Two Things you Don't Need to hear from your Listing Agent

You’ve decided to sell your house. You begin to interview potential

real estate agents to help you through the process. You need someone you

trust enough to:

Be careful if the agent you are interviewing begins the interview by:

Look for someone with the ‘heart of a teacher’ who comes in prepared well enough to explain the current real estate market and patient enough to take the time to show how it may impact the sale of your home. Not someone only interested in trying to sell you on how great they are.

You have many agents from which to choose. Pick someone who truly cares.

- Set the market value on possibly the largest asset your family owns (your home)

- Set the time schedule for the successful liquidation of that asset

- Set the fee for the services required to liquidate that asset

Be careful if the agent you are interviewing begins the interview by:

- Bragging about their success

- Bragging about their company’s success

Look for someone with the ‘heart of a teacher’ who comes in prepared well enough to explain the current real estate market and patient enough to take the time to show how it may impact the sale of your home. Not someone only interested in trying to sell you on how great they are.

You have many agents from which to choose. Pick someone who truly cares.

Tuesday, January 28, 2014

Don’t Wait! Move Up to the Home You Always Wanted!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates are still below 5%.

However, sellers should realize that waiting to make the move while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can buy will decrease. Here is a chart detailing this point:

However, sellers should realize that waiting to make the move while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can buy will decrease. Here is a chart detailing this point:

Monday, January 27, 2014

Home Sales Reach 7 Year High

There are many naysayers declaring that the housing market is still challenged.

Young adults are burdened with too much student debt. Interest rate increases are killing demand. Homeownership is no longer seen as part of the American Dream.

We just want to let these naysayers know three things: 13,945 houses sold yesterday, 13,945 will sell today and 13,945 will sell tomorrow. 13,945!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, there were 5.09 million homes sold in 2013. Divide that number by 365 (days in a year) and we can see that, on average, almost 14,000 homes sell every day.

NAR revealed that sales had increased 9.1% as compared to 2012 and that it was the market’s strongest performance since 2006.

We realize that these numbers are below the record for homes sold during the boom. We also know that we may not see those numbers again for a long time (and that is probably a good thing). But to say that the current real estate market is challenged is totally inaccurate. We have about 14,000 pieces of evidence to prove that.

Young adults are burdened with too much student debt. Interest rate increases are killing demand. Homeownership is no longer seen as part of the American Dream.

We just want to let these naysayers know three things: 13,945 houses sold yesterday, 13,945 will sell today and 13,945 will sell tomorrow. 13,945!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, there were 5.09 million homes sold in 2013. Divide that number by 365 (days in a year) and we can see that, on average, almost 14,000 homes sell every day.

NAR revealed that sales had increased 9.1% as compared to 2012 and that it was the market’s strongest performance since 2006.

We realize that these numbers are below the record for homes sold during the boom. We also know that we may not see those numbers again for a long time (and that is probably a good thing). But to say that the current real estate market is challenged is totally inaccurate. We have about 14,000 pieces of evidence to prove that.

Friday, January 24, 2014

Home Sales in 2013 Rise to Strongest Level in 7 Years

Daily Real Estate News | Friday, January 24, 2014

The housing market has been experiencing a “healthy recovery” over the past two years, with home sales last year rising to the highest level since 2006, according to the National Association of REALTORS®' latest housing report.“Existing-home sales have risen nearly 20 percent since 2011, with job growth, record low mortgage interest rates, and a large pent-up demand driving the market,” says Lawrence Yun, NAR’s chief economist. “We lost some momentum toward the end of 2013 from disappointing job growth and limited inventory, but we ended with a year that was close to normal given the size of our population.”

Existing-home sales rose 1 percent in December 2013 compared to November and reached a seasonally adjusted annual rate of 4.87 million.

Existing-home sales for all of 2013 reached 5.02 million sales, 9.1 percent higher than 2012, and the largest rise since 2006 when sales were at 6.48 million at the close of the housing boom, NAR reports.

Home prices were also on the rise in 2013, up 11.5 percent over 2012, with a median existing-home price of $197,100 last year compared to $176,800 in 2012. It was the strongest gain in home prices in a year since 2005, when home prices rose 12.4 percent, NAR reports.

NAR President Steve Brown says that with job growth expected this year, home sales should hold despite rising home prices and higher mortgage rates.

“The only factors holding us back from a stronger recovery are the ongoing issues of restrictive mortgage credit and constrained inventory,” Brown says. “With strict new mortgage rules in place, we will be monitoring the lending environment to ensure that financially qualified buyers can access the credit they need to purchase a home.”

Housing Recovery Regional Snapshot

Here’s a look at how existing-home sales fared in December and for the year across the country:

- Northeast: Existing-home sales fell 1.5 percent in December but remain 3.2 percent higher than December 2012. Median price: $239,300, up 3.6 percent from year ago levels

- Midwest: Existing-home sales dropped 4.3 percent in December and are 0.9 percent below year ago levels. Median price: $150,700, 7 percent higher than December 2012.

- South: Existing-home sales rose 3 percent in December and are 4.6 percent higher than December 2012. Median price: $173,200, up 8.9 percent from a year ago.

- West: Existing-home sales increased 4.8 percent, but are 10.7 percent below a year ago. Median price: $285,000, up 16.0 percent from December 2012.

Wednesday, January 22, 2014

Tuesday, January 21, 2014

4 Things you Need from your Listing Agent

Are you thinking of selling your home? Are you dreading having to deal with strangers walking through the house? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of selling. A great agent is always worth more than the commission they charge just like a great doctor or great accountant. You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one. Let us help.

If we were hiring an agent to sell our home today, we would require that they:

1. Understand the timetable with which my family is dealing

You will be moving your family to a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan. This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. I am not suggesting that your agent can pick the exact date for your move. You just want the agent to exert any influence they can.2. Remove as many of the challenges as possible

It is imperative that your agent know how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.Remember: If you have an agent who was weak negotiating with you on the parts of the listing contract that were most important to them (commission, length, etc.), don’t expect them to turn into Superman when they are negotiating for you with your buyer.

3. Help with the relocation

If you haven’t yet picked your new home, make sure the agent is capable and willing to help you. The coordination of the move is crucial. You don’t want to be without a roof over your head the night of the closing. Likewise, you don’t want to end up paying two housing expenses (whether it is rent or mortgage). You should, in most cases, be able to close on your current home and immediately move into your new residence.4. Get the house SOLD!

There is a reason you are putting yourself and your family through the process of moving. You are moving on with your life in some way. The reason is important or you wouldn’t be dealing with the headaches and challenges that come along with selling. Do not allow your agent to forget these motivations. Constantly remind them that selling the house is why you hired them. If they discover something needs to be done to attain your goal (i.e. price correction, repair, removing clutter), insist they have the courage to inform you.Make sure you let your agent know what you and your family expect from them.

Christie Farris - Baton Rouge Realtor

225-315-9003

Christiefarris@gmail.com

www.christiefarris.com

Monday, January 20, 2014

3 Questions to Ask Before Buying a Home

If

you are thinking about purchasing a home right now, you are surely

getting a lot of advice. Though your friends and family have your

best interests at heart, they may not be fully aware of your needs

and what is currently happening in real estate. Let’s look at

whether or not now is actually a good time for you to buy a home.

There

are three questions you should ask before purchasing in today’s

market:

1. Why am I buying a home in the first place?

This truly is the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with finances. A study by the Joint Center for Housing Studies at Harvard University reveals that the four major reasons people buy a home have nothing to do with money:- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of the space

2. Where are home values headed?

When looking at future housing values, we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.Here is what the experts projected in the latest survey:

- Home values will appreciate by 4.3% in 2014.

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the

survey still are projecting a cumulative appreciation of over 16.8%

by 2018.

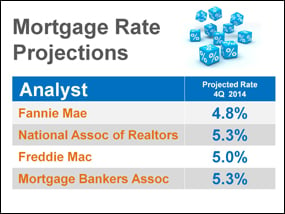

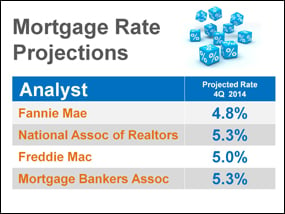

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by an increase in mortgage rates.The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase by approximately one full percentage over the next twelve months.

Bottom Line

Only you and your family can know for certain the right time to purchase a home. Answering these questions will help you make that decision.Sunday, January 19, 2014

Friday, January 17, 2014

4 Keys for Full Housing Recovery

4 Keys Identified for a Full Housing Recovery

In order to have a fully recovered housing market and economic recovery, economists point to the need for four positive indicators:1. A healthy job market with low stable unemployment;

2. Mortgage delinquencies that have returned to historical averages;

3. Home prices consistent with an affordable mortgage payment–to–income ratio;

4. Home sales that are in the range of historical norms.

Boomerang Buyers

“Boomerang buyers” are former homeowners who have gone through a

short sale, foreclosure, or bankruptcy in the past few years and are

saving up for a down payment to purchase a home again.

Wednesday, January 15, 2014

Baton Rouge Area Home Sales Rise 15%

Baton Rouge metro area home sales increased by 15 percent during

2013, continuing a steady recovery from the national recession that

followed a spike in sales after Hurricane Katrina.

According to figures provided by the Greater Baton Rouge Association of Realtors, there were 8,690 closed sales in 2013, compared with 7,483 in 2012.

Though 2013 doesn’t rival the Hurricane Katrina-aided years from 2005 to 2007, last year fell only 59 houses shy of the 8,749 sold pre-Katrina in 2004 in the Capital Region.

Sales fell from 2008 to 2010 before starting a recovery from the national recession.

Home sales picked back up really strong, interest rates are staying low, and that’s really helped the market. Locally, it remains a seller’s market because of the limited inventory.

At the end of 2013, there were 3,896 homes for sale, down 2.6 percent from the 3,999 listings at the end of 2012. That dropped the supply of homes from 6.1 months at the end of 2012 to 5.4 months in December 2013. For all of 2013, the number of days a home remained on the market dropped by 11.3 percent, from 97 to 86.

Annual sales increased by 18.5 percent in Livingston Parish, where there were 1,475 sales in 2013, compared with 1,245 in 2012. Not only have sales come up, quantity-wise, but the values of the homes sold have raised. Homebuyers have been attracted to moving into Livingston Parish because infrastructure improvements such as the widening of Interstate 12 and the Magnolia Bridge have made it easier to get to work at the chemical plants in north Baton Rouge and Ascension Parish.

East Baton Rouge Parish, the largest homebuying market, went from 4,124 sales in 2012 to 4,698, a 13.9 percent increase. Neighborhoods around LSU and Town Center remained popular with homebuyers, along with Central.

The median sale price for a home in metro Baton Rouge increased by 4.2 percent during the year, going up from $167,000 to $174,000. That’s a local record for the median sale price of a home, said Saiward Pharr Hromadka, a spokeswoman for the Greater Baton Rouge Association of Realtors.

The median means half the homes sold for more than that amount and half for less.

So far, 2014 is off to a good start, because historically low interest rates are continuing.

According to figures provided by the Greater Baton Rouge Association of Realtors, there were 8,690 closed sales in 2013, compared with 7,483 in 2012.

Though 2013 doesn’t rival the Hurricane Katrina-aided years from 2005 to 2007, last year fell only 59 houses shy of the 8,749 sold pre-Katrina in 2004 in the Capital Region.

Sales fell from 2008 to 2010 before starting a recovery from the national recession.

Home sales picked back up really strong, interest rates are staying low, and that’s really helped the market. Locally, it remains a seller’s market because of the limited inventory.

At the end of 2013, there were 3,896 homes for sale, down 2.6 percent from the 3,999 listings at the end of 2012. That dropped the supply of homes from 6.1 months at the end of 2012 to 5.4 months in December 2013. For all of 2013, the number of days a home remained on the market dropped by 11.3 percent, from 97 to 86.

Annual sales increased by 18.5 percent in Livingston Parish, where there were 1,475 sales in 2013, compared with 1,245 in 2012. Not only have sales come up, quantity-wise, but the values of the homes sold have raised. Homebuyers have been attracted to moving into Livingston Parish because infrastructure improvements such as the widening of Interstate 12 and the Magnolia Bridge have made it easier to get to work at the chemical plants in north Baton Rouge and Ascension Parish.

Ascension Parish had a 17 percent increase in sales, going from 1,425 in 2012 to 1,667.

Ascension Parish had a good spring and a

good summer and went through quite a bit of inventory. Gautreau

said sales started to slump at the end of 2013 because of dwindling

inventory, a slight increase in interest rates and concern about

dramatic hikes in flood insurance rates.East Baton Rouge Parish, the largest homebuying market, went from 4,124 sales in 2012 to 4,698, a 13.9 percent increase. Neighborhoods around LSU and Town Center remained popular with homebuyers, along with Central.

The median sale price for a home in metro Baton Rouge increased by 4.2 percent during the year, going up from $167,000 to $174,000. That’s a local record for the median sale price of a home, said Saiward Pharr Hromadka, a spokeswoman for the Greater Baton Rouge Association of Realtors.

The median means half the homes sold for more than that amount and half for less.

So far, 2014 is off to a good start, because historically low interest rates are continuing.

Tuesday, January 14, 2014

Prediction: 2014 the 'Year of the Big Move'

Prediction: 2014 the 'Year of the Big Move'

Daily Real Estate News |

Tuesday, January 14, 2014

Here are some factors he points to:

- Rising mortgage rates: Mortgage rates are expected to nudge higher this year from their historical lows as the Federal Reserve starts tapering its bond-buying stimulus program. “For many would-be homebuyers, an increase of 1 percentage point could make monthly mortgage and interest payments in their current area beyond their reach,” Young says.

- Dropping affordability: Incomes are not keeping pace with the rises in home prices. “That means homes are getting more expensive faster than our wages can keep up,” Young says. With higher mortgage rates and higher home prices, affordability is falling in many higher-priced markets, he notes.

- Returning equity: As home prices have risen, many home owners have seen equity return and are finally in a position where they can move again. More home owners may look at other states for a lower cost of living, better job opportunities, and better weather, too, Young says.

- Rebuilding personal wealth: Many people faced a big hit to personal wealth during the recession and as they rebuild it, they may find that their current area has too high of a cost of living to rebuild comfortably.

Impact of Increasing Mortgage Rates on Prices

Many pundits are warning that there will be a drop in real estate

values because mortgage rates are beginning to increase. The logic makes

sense. However, history shows that increasing rates have not negatively

impacted home values in the past.

Four times over the last 30 years mortgage interest rates have dramatically increased. Here is the impact the increases had on home values at the time:

Four times over the last 30 years mortgage interest rates have dramatically increased. Here is the impact the increases had on home values at the time:

Dates |

Mortgage Rate |

Home Values |

| May ‘83 - July ‘84 |

12.63 – 14.67

|

+ 6.6%

|

| March - Oct ‘87 |

9.04 – 11.26

|

+ 5.2%

|

| Oct ’93 - Dec ‘94 |

6.83 – 9.2

|

+ 1.2%

|

| April ’99 -May 2000 |

6.92 – 8.52

|

+ 10.9%

|

Monday, January 13, 2014

Congratulations Christine!

Congratulations on your beautiful new home

Christine! I could not ask for a better client! I am so happy to have

you here in Baton Rouge!

#1 Reason You Should Sell Your Home Now

The price of any item (including residential real estate) is

determined by ‘supply and demand’. If many people are looking to buy an

item and the supply of that item is limited, the price of that item

increases.

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increasing every spring. Putting your home on the market now instead of waiting for the increased competition of the spring might make a lot of sense.

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory available in most markets currently, a seller will be in a great position to negotiate.

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increasing every spring. Putting your home on the market now instead of waiting for the increased competition of the spring might make a lot of sense.

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory available in most markets currently, a seller will be in a great position to negotiate.

Friday, January 10, 2014

The Latest on Housing Affordability

The Latest on Housing Affordability

At the national level, housing affordability is up for the month due to a break in mortgage rates and home prices gains but affordability will be down for the year. What is affordability like in your market?

At the national level, housing affordability is up for the month due to a break in mortgage rates and home prices gains but affordability will be down for the year. What is affordability like in your market?

- Housing affordability is up for the month of November as mortgage rates and the median price for a single family home in the US decreased slightly from October. In spite of the decrease, the median single-family home price is up 9.4 % from last year keeping prices moving at a high year-over-year pace.

- As a result of higher home prices and mortgage rates that are up 25.1%, nationally, affordability is down from 203 in November 2012 to 170.3 in November 2013.

- Home prices are expected to slow down while inventory figures improve. Income levels are up and should help consumer confidence before rates begin to rise for the coming year.

- By region, affordability is up from one month ago in all regions. The Midwest had the biggest gain in affordability at 3.4%. From one year ago, affordability is down in all regions. The West saw the biggest decline in affordability as a result of having the largest price gain at 15.9 %.

- Mortgage rates are expected to increase as the Fed reduces bond purchases and eventually begins to tighten monetary policy. For a look at how the housing market might respond to a change in rates, I recommend this Stress Test by Chief Economist Lawrence Yun.

- What does housing affordability look like in your market? View the full data release here.

- The Housing Affordability Index calculation assumes a 20 percent down payment and a 25 percent qualifying ratio (principle and interest payment to income). See further details on the methodology and assumptions behind the calculation here.

Wednesday, January 8, 2014

Predictions for 2014: Interest Rates Will Increase Significantly

Most experts are calling for an increase in mortgage interest rates

in 2014. However, we believe the increase will be more dramatic than is

being projected. We believe rates will be closer to 6% than 5% by year’s

end.

The Fed announced last month that they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of this likelihood over the last several months.

Above are the most recent projections of where rates will be at the end of 2014 by the four major agencies. However, we believe that the government is not afraid to shoot right past these levels.

Doug Duncan, chief economist for Fannie Mae, this past summer announced:

“I don’t think the Fed ultimately would be troubled with a 6.5% mortgage rate.”

And Frank Nothaft, Freddie Mac VP and chief economist, at virtually the same time explained:

"As the economy continues to improve, we expect to see continued upward movement in long-term interest rates… At today’s house prices and income levels, mortgage rates would have to be nearly 7 percent before the U.S. median priced home would be unaffordable to a family making the median income in most parts of the country.”

Only time will tell. However, we feel that rates will be in the 5.75-6% range by year’s end.

The Fed announced last month that they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of this likelihood over the last several months.

Above are the most recent projections of where rates will be at the end of 2014 by the four major agencies. However, we believe that the government is not afraid to shoot right past these levels.

Doug Duncan, chief economist for Fannie Mae, this past summer announced:

“I don’t think the Fed ultimately would be troubled with a 6.5% mortgage rate.”

And Frank Nothaft, Freddie Mac VP and chief economist, at virtually the same time explained:

"As the economy continues to improve, we expect to see continued upward movement in long-term interest rates… At today’s house prices and income levels, mortgage rates would have to be nearly 7 percent before the U.S. median priced home would be unaffordable to a family making the median income in most parts of the country.”

Only time will tell. However, we feel that rates will be in the 5.75-6% range by year’s end.

Tuesday, January 7, 2014

Predictions for 2014: Supply Will Struggle to Keep Up with Demand

With a dramatic increase in demand for housing expected this year, it

will be up to real estate professionals and builders to make sure there

is the necessary inventory to satisfy this demand. This will be a

challenge for much of 2014.

For a balanced real estate market, there should be approximately 5-6 months of inventory for sale (example: if 100 homes sold last month, we would need 500-600 homes available for sale). Nationally, we are just now hitting the five month level. As the spring selling season begins to heat up, a new wave of housing inventory would have to come to market to keep up with the increasing demand of buyers.

If we couple this seasonal increase with the other dynamics that will increase demand for housing in 2014, we believe that housing inventory could drop substantially. This, in our opinion, is the biggest threat to a full blown surge in sales this year.

Some experts have looked at the recent monthly decline in existing home sales nationally as evidence that a lack of consumer confidence or the increase in interest rates has buyers back up on the fence. However, a closer look at existing home sales reveals that sales remained unchanged in one of the four regions of the country (the Midwest) and actually increased in two other regions (the Northeast and the South). The only region that had a decrease in sales was the Western region (down over 10%).

If it was a matter of consumer confidence or mortgage rates, there would have been a similar decrease in sales throughout all four regions. The fall-off in sales in the West is directly attributable to a lack of salable inventory in the hottest markets in the region.

It is up to the builders and real estate agents in each community to make sure this doesn’t happen.

For a balanced real estate market, there should be approximately 5-6 months of inventory for sale (example: if 100 homes sold last month, we would need 500-600 homes available for sale). Nationally, we are just now hitting the five month level. As the spring selling season begins to heat up, a new wave of housing inventory would have to come to market to keep up with the increasing demand of buyers.

If we couple this seasonal increase with the other dynamics that will increase demand for housing in 2014, we believe that housing inventory could drop substantially. This, in our opinion, is the biggest threat to a full blown surge in sales this year.

Some experts have looked at the recent monthly decline in existing home sales nationally as evidence that a lack of consumer confidence or the increase in interest rates has buyers back up on the fence. However, a closer look at existing home sales reveals that sales remained unchanged in one of the four regions of the country (the Midwest) and actually increased in two other regions (the Northeast and the South). The only region that had a decrease in sales was the Western region (down over 10%).

If it was a matter of consumer confidence or mortgage rates, there would have been a similar decrease in sales throughout all four regions. The fall-off in sales in the West is directly attributable to a lack of salable inventory in the hottest markets in the region.

It is up to the builders and real estate agents in each community to make sure this doesn’t happen.

Sunday, January 5, 2014

Smart Growth in the New Year for Baton Rouge

Smart growth in the new year

for Baton Rouge

The year behind us included several huge announcements for developments

in Baton Rouge, and all of these projects look to improve the urban core

of the city in 2014. We take a look at the stats on some of these

projects below:

MATHERNE'S COMING TO DOWNTOWN

OK, so a new grocery store wouldn't seem like a big deal to many. But

for downtown Baton Rouge—technically considered a food desert and

currently trying to beef up its residential numbers—news that Matherne's Supermarket is coming to the former Capitol One building

on Third Street is exciting. Besides a convenience store in Spanish

Town and on the corner of Third and Florida streets, there aren't any

full-service grocery stores downtown. This supermarket will provide

plenty of amenities as downtown tries to encourage more residential

development.

Dubbed 440 on Third, the building itself will also feature 65

residential units as well as retail and commercial space. Construction

on the grocery store is underway with it set to open in fall 2014.

A POSSIBLE TRAIN STATION?

What are those, even? Train stations, like, in Europe? In December, Entergy donated a six-acre site

on Government Street worth $1.75 million to the East Baton Rouge

Redevelopment Authority. The site—long unused and fenced in—sits along

the railroad tracks, and while there is no word yet on whether the old

brick buildings will be renovated or demolished, the RDA mentioned it as

a possible future site of a passenger train station that would link

Baton Rouge to New Orleans.

For now, construction is set to start summer 2014 for some type of

mixed-use development the RDA hopes will anchor the “warehouse district”

that connects downtown and Mid City.

That area has seen quite a bit of activity, with mixed-income housing

developments recently completed on Spanish Town Road and two corners of

North and 19th streets. Earlier in 2013, several blocks east of I-110

were added to the Downtown Development District in an effort to spur

more growth in the sparsely populated edge of downtown.

THE WATER INSTITUTE COMETH

Probably the biggest announcement of the year for Baton Rouge, the Water

Institute involves the city, the state, LSU and several other entities

to create a research campus just south of the Mississippi River Bridge.

It brings a lot of positive opportunities with it:

It embraces the river: As we've discussed before,

Baton Rouge has long been a city next to a river that it rarely sees as

an asset to quality of life. Renovating the old city dock and turning

it into a $20 million Education and Research Center will bring more life

to the riverfront. Check out a rendering of the structure here.

It will help revitalize Old South: The campus, which

will eventually house several public and private entities, is just one

of several developments in the works along the Nicholson Drive corridor

between downtown and LSU. The increased activity and development could

help spur improvements to the poorer neighborhoods to the east of that

section of Nicholson Drive, where groups like Center for Planning

Excellence and the Arts Council are already working on revitalization efforts.

It will encourage public transit: The renderings for the Water Institute campus include images of a tram system along Nicholson Drive—so it must be finally happening!

Local leaders have long been looking for ways to connect the university

to downtown, and light rail between the two areas along Nicholson was

always the most obvious option. With so much high-density development

along this route in the works, some type of regular public transit would

not just be a plus—it will be paramount to making the whole thing work.

Furthermore, with the campus expected to create 20,000 to 45,000 jobs in coastal water management over the next decade (Read about that economic impact here.),

it's likely that many of those employees will be traveling up and down

our super region constantly. Maybe this will add more steam to the idea

of commuter rail linking Baton Rouge and New Orleans—an idea both cities

still want.

MORE TO WATCH

BREC's Medical Loop: A portion of the Capital Area Pathways Project

next to the Mall of Louisiana was completed this year, and while BREC

works on grants to continue construction on the biking and walking path,

LSU has already approved leasing some land at Pennington Biomedical Research Center to extend the path even further. See a map of the conceptual plan here.

IBM comes to downtown: Construction is already underway at this new $55 million complex downtown,

which is part of a mixed-use development that will include commercial

and retail space and luxury apartments. This development on its own

would have been the big game changer for 2013 had the Water Institute

announcement not come just months later. Still, paired together, the

future looks busy and bright for Baton Rouge.

Image above via the Water Institute of the Gulf's early concept designs.

Subscribe to:

Posts (Atom)

Christie Farris

Baton Rouge Real Estate